- Not insured by the FDIC or any other government agency

- Not bank guaranteed

- Not a deposit or obligation

- May lose value

Your approach to setting long-term financial goals can directly impact the likelihood of achieving them. Knowing how to set and revisit your financial goals is key to building the wealth you need to realize your future dreams. Whether it’s having a stress-free retirement or building financial independence to pursue a new passion, it all begins with goal setting. Let us clearly define long-term financial goals and give concrete examples of how to set and achieve them.

Long-term financial goals are the targets you set to improve your finances over time, cover future expenses, or replace an income stream. No exact time range defines a long-term goal from a short-term one, and the answer might change depending on who you ask. However, a general rule for long-term goals could be anything that typically takes you five years or longer to accomplish. Some examples of long-term financial goals may include:

Again, how long it will take you to achieve the goal will give you the best sense of if it is a long-term one or not. What affects that number the most is usually your income, other financial commitments, and the size of the financial goal. All of these factors will help determine the priority you place on achieving a particular goal, which will also help you properly categorize your financial targets. For example, paying down credit card debt could just as easily be a short-term and long-term goal, depending on your other priorities (e.g., building an emergency fund). Regardless of your personal finances, here are some things to consider that could help you set and achieve long-term money goals.

Like other goals, ones involving finances should be specific, measurable, achievable, relevant, and time-bound (i.e., SMART). Focusing on the time-bound aspect, it’s important that you set a date for when you want to achieve a particular goal.

Some of your long-term financial goals will have pre-defined dates because of their nature. For example, paying off your mortgage will depend on its maturity date (e.g., 15 or 30 years), or paying for your child’s college education will depend on their age and when they plan to attend school. However, other long-term financial goals can have a more flexible date for achievement. Retirement goals, for instance, can vary greatly from person to person. While adjusting dates may be necessary over time, having a specific date for your initial goal will help you create a realistic strategy.

Long-term financial goals can be challenging because of the large time gaps between setting the goal and planning to achieve it. A lot can happen in between that derail or delay your progress. You may have changes in employment, surprise expenses (e.g., medical bills), and other circumstances that impact your goals.

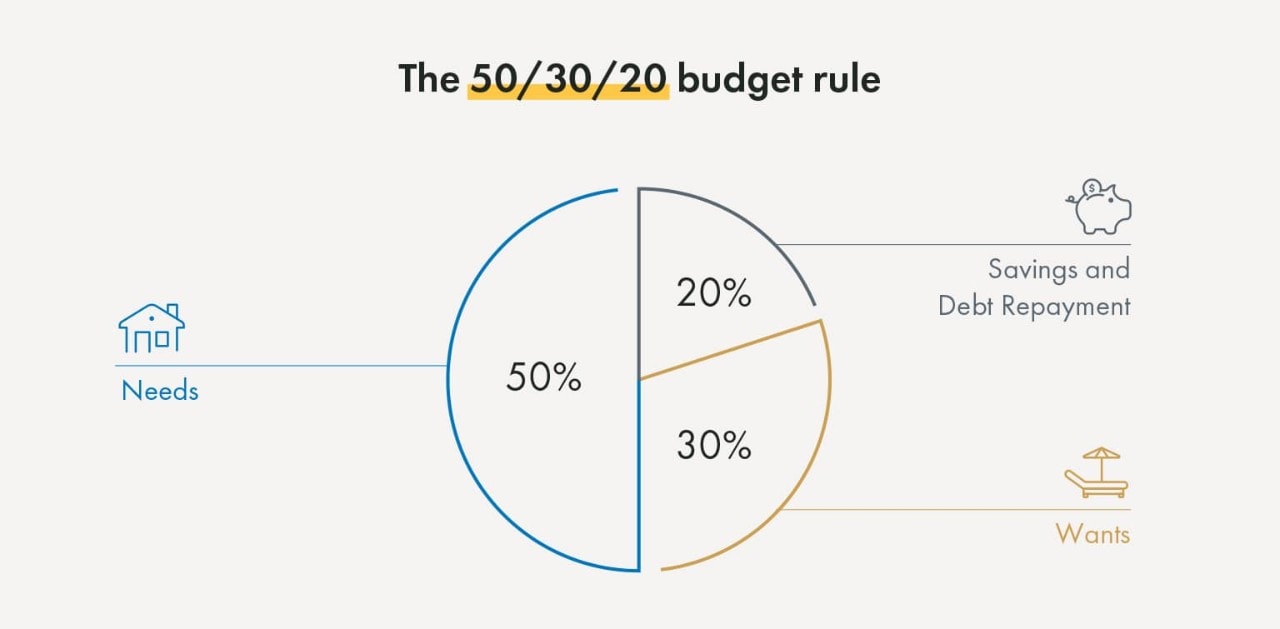

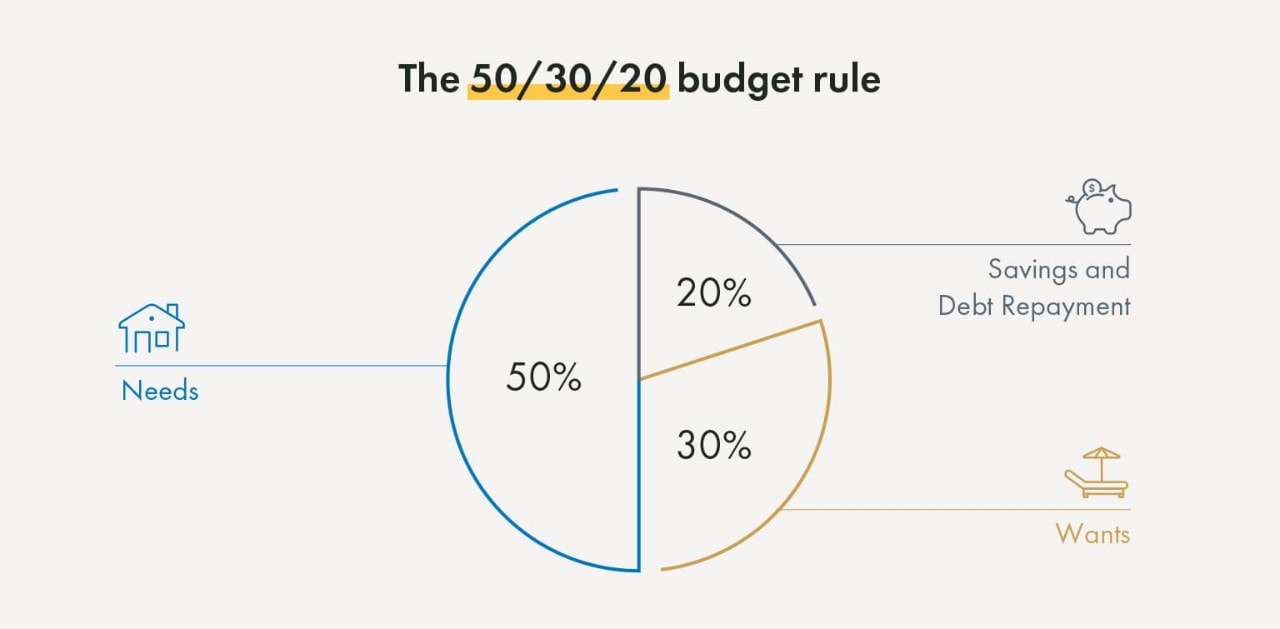

To keep you on track, set intermediary goals. These goals will help you maintain your commitment to the long-term goal and simplify the process. For example, suppose you want to pay off $10,000 in credit card debt within the next two years. Without considering the interest that would accrue, you could set intermediary goals of having paid off $5,000 after the first year and even smaller goals after that (e.g., paying off $417 per month). Another example would be using automated savings strategies like the 50/30/20 budget rule.

In conjunction with intermediary goals, you should schedule time to review your finances and progress toward specific targets. The frequency of your reviews will likely depend on the timeframe for your goal. In many cases, an annual or quarterly review could make the most sense so that not too much time passes in which you might lose accountability.

These reviews are also helpful for evaluating the benefit (or lack thereof) of continuing with the long-term financial goal. Changes in your life can greatly affect the overall value of a goal, and it may make sense to modify or discontinue a goal. For example, you could get a raise or bonus at work that might allow you to lessen the time needed to pay off a debt or allow you to pay off the debt altogether.

As you navigate life, every day will present opportunities and challenges for reaching your long-term financial goals. Your short-term financial decisions will directly and indirectly impact long-term goals. How you spend and allocate your financial resources is important to consider as you work toward your goals. While related, this goes beyond the choice of buying your morning coffee on the way to work and has more to do with being financially literate. For example, here are some common types of financial decisions that will present different value propositions for your long-term goals:

Setting long-term goals and taking a proactive approach is a great step towards securing the future lifestyle you want to live. However, the potential for accidents and the unexpected always exist, jeopardizing your ability to meet long-term financial goals. When setting your goals, consider different safeguards to protect against risks, such as having life or disability insurance. Establishing an estate plan with a will or trust may also help your long-term financial goals in worst-case scenarios by providing for your family.

Another resource for protecting the long-term financial goals you set is to enlist the assistance of a wealth advisor. At Yellow Cardinal, our advisors aim to provide an objective perspective along with useful information to help steward the achievement of your wealth goals. We are available to meet with you in person or through virtual channels via phone or email. Don’t prolong your future financial happiness, and come see why our clients trust us as a resource for their long-term planning.

Contact Yellow Cardinal to connect with an advisor and get started.

Graphic Image 1: Adapted from “Plan Your Financial Future at Any Age,” Intuit MintLife; https://mint.intuit.com/blog/investments/long-term-financial-goals/

Graphic Image 2: Adapted from “Budget Calculator,” NerdWallet; https://www.nerdwallet.com/article/finance/nerdwallet-budget-calculator

The information on this page is accurate as of September 2022 and is subject to change. First Financial Bank and Yellow Cardinal Advisory Group are not affiliated with any third-parties or third-party websites mentioned above. Any reference to any person, organization, activity, product, and/or service does not constitute or imply an endorsement. By clicking on a third-party link, you acknowledge you are leaving bankatfirst.com. First Financial Bank and Yellow Cardinal Advisory Group are not responsible for the content or security of any linked web page.

You are about to go to a different website or app. The privacy and security policies of this site may be different than ours. We do not control and are not responsible for the content, products or services.

Online banking services for individuals and small/medium-sized businesses.

If you haven't enrolled yet, please enroll in online banking.

Yellow Cardinal resources

* Are not insured by the FDIC. Not a deposit. May lose value.

f1RSTNAVIGATOR is where our business clients can access tools to help manage day-to-day account activity.

If you’re a Westfield Bank client OR new to fIRSTNAVIGATOR Online Banking after 02/26/26, sign in here to access your day-to-day account activity. Current First Financial clients should continue to use the sign in above.

If you are still unsure, please contact the Business Support Center at 866.604.7946.

You are encouraged to bookmark the platform page once you have successfully accessed your account.