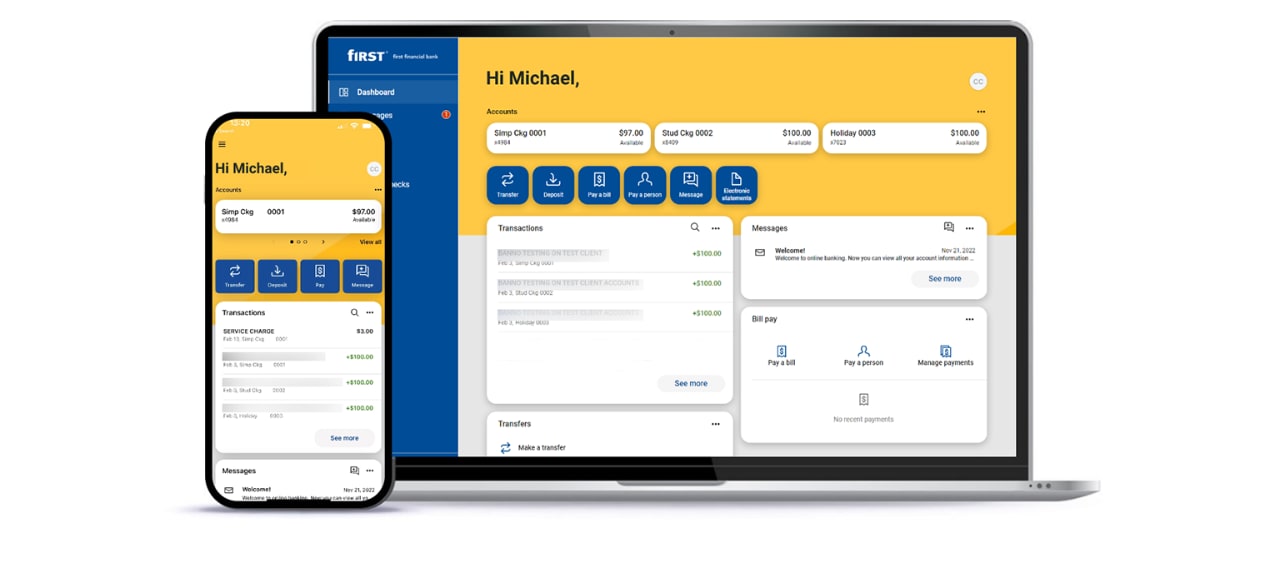

Getting started with online and mobile banking

Online and mobile banking FAQs

Online Bill Pay

Bill Pay FAQs

Account alerts

Account alert FAQs

Mobile check deposit

Mobile check deposit FAQs

Money management

Money management FAQs

Digital wallet FAQs

How to link your First Financial Bank account with Quicken® or QuickBooks®

Still need help?

Give us a call or find a financial center near you to get personalized assistance and guidance.

More about online and mobile banking

1 Standard messaging and data rates may apply.

2 Balance Boost is a borrowing feature included with most personal use First Financial Bank checking accounts. Any joint account holder must be 18 or older and enrolled in Online Banking to use Balance Boost. With an eligible checking account open for 30 days or more, your ability to use Balance Boost and the amount you are able to borrow is based on your First Financial Bank checking account history, including but not limited to account balances, transactions, overdrafts and return history. An active or recent bankruptcy or other legal process may disqualify you.

Balance Boost is subject to terms and conditions on your loan agreement. You can borrow in increments of $1 with a minimum borrowing amount of $200. The maximum amount you may be eligible to borrow is $1,000. Although your credit score is not used to determine eligibility, once you borrow money using Balance Boost, your account and activity will be reported to the credit bureaus. Balance Boost may positively or negatively affect your credit score. The Courtesy Cash limit on your checking account is reduced when you have an outstanding balance on your Balance Boost.

Funds may be deposited into and available in your First Financial Bank checking account in as quickly as 5 minutes. Although 5 minutes is typical, there may be times when funds are not deposited and available in your checking account until the next day depending on processing times. A Balance Boost loan must be paid in full with at least a one day waiting period before another Balance Boost loan may be approved (only one outstanding loan at a time per checking account and per individual). No more than three Balance Boost loans may be approved within a rolling 6-month period on any given checking account or by any individual.

3 Subject to carrier availability and processing limitations.

4 Deposits are subject to verification and not available for immediate withdrawal. Daily deposit dollar and count limits may vary and are subject to change at our discretion. Data or message fees from your wireless carrier may apply. Online banking enrollment is required for mobile deposit and mobile apps.

Accounts subject to Online Services User Agreement. All deposit accounts are subject to the Terms and Conditions, Special Handling/Electronic Banking Disclosure of Charges, and possibly other disclosures.