save small, but DREAM big: the 26-week challenge

Starting at $3 a week, change how you think about money

Most of us think nothing of spending $3 on a small item, from pack of breath mints to an energy bar. But when you rethink making these purchases one day at a time, the money saved can add up to enough to buy a computer, cover home repairs, or take a vacation.

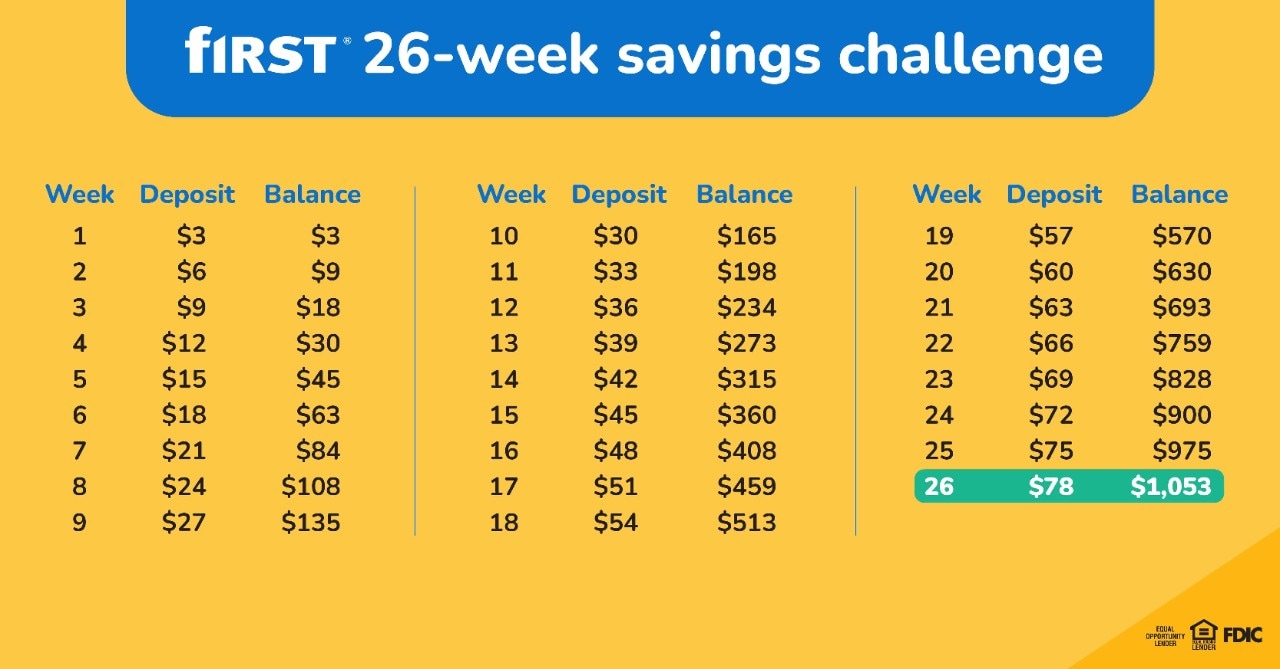

That’s the working theory behind the 26-week savings challenge – a simple, $3 approach to saving more than $1,000 in just six months. The plan is refreshingly easy, even for the math-challenged: set aside $3 in the first week and put it into a savings account. Then add another $3 each week after, so $6 is saved in week two, $9 in week three, and so on.

By week 26, when the final deposit of $78 is made, the savings will total $1,053. If $78 sounds like a lot, keep in mind that by the time you get to that point, you’ve already found easy ways to save that feel rewarding, not sacrificing.

That is the key benefit of the 26-week challenge: Its slow build gives you time to adjust, reflect, and get creative about savings. Here are some ideas to help you get started.

7 ways to save every day

Review the grocery list. We’ve got to eat, but do we really need to eat a $4.99 box of gourmet fig bars? A moderate grocery budget for a family of four is more than $255 a week. Build a grocery list, and stick with it. By planning the week’s meals in advance, a household can better manage its budget ahead of time. And don’t even go down those aisles that don’t carry goods on your list.1 You can also use the online shopping option at some grocers. Buying online before you go saves you time and money while helping you avoid impulse purchases.

Switch brands. Do a little research into the products you regularly buy and see if alternative brands, including less-expensive private-label goods, get strong reviews. This strategy applies to food as well as shoes (yes, there are alternatives to Allbirds). A combined $50 difference in prices would more than cover week 16.

Rethink subscriptions. By late 2021, the average person held five retail subscriptions at an average cost of nearly $38 each. That’s more than what’s required in savings for week 12.2 Now add in other subscriptions, such as magazines, music (think Spotify), and video streaming. Cut ties with those that are not used regularly – or at least once a week.

Pack a lunch. Yeah, a homemade lunch is low-hanging fruit (which you should pack instead of pricey pre-made snacks), but for good reason. A packed lunch can cost $4 or less, while lunch at a quick-serve restaurant averages $8, and often $15 or more at a sit-down restaurant. That’s $4 to $11 that can be saved – in one day.3 Tip: Ask a few co-workers to join in your brown-bag challenge, to help hold you accountable. The group can share lunch recipes and save together.

Review mobile plans. It might not be exciting, but a quick review of the line-by-lines of a mobile phone bill could reveal unnecessary expenses, such as way more minutes than needed and even roadside assistance. Money-wise, a no-contract phone is the smartest bet.4 Some phone companies have offers that give you a better price if you switch from your old provider. It pays to shop around.

Host friends at home. Replace one weekly after-work happy hour with a happy-to-be-home hour, and save $10 or more. Invite friends or go it alone. A beer or cocktail isn’t necessary; an hour of “you” time in the tub or on the deck watching Netflix is happy enough.

Avoid “therapy” spending. Many of us retreat to a favorite place for alone time after work and between errands. Drive on by that Target or Ace Hardware and instead head to a park or explore a new neighborhood on foot. The 24 hour rule is one way to avoid impulse buying online. Instead of clicking buy now, just add the items to your cart and wait until later to see if you still want to buy them. After 26 weeks, you will be financially and physically fit (and maybe reexamining that gym membership).

Plan ahead and DREAM big

The more we condition our brains to reconsider the things we buy, the more financial control we gain. The beauty of the 26-week challenge is not just the money saved, it’s the discovery of more productive, less emotional reasoning regarding our purchase choices.

If you feel you will need help meeting your weekly goals, ask someone to be your accountability partner – that’s someone who will hold you responsible for your savings commitment. Easy financial planning exercises should also help: For example, writing out your weekly spending budget could make it easier to recognize expenses that can be cut. Bonus: This exercise can also be the first step toward more long-term financial planning.

And sure, after week 26 you will have more than enough to splurge on those $140 Allbirds. Or you may decide to up the challenge and go an additional 26 weeks. We’re here to help out, either way.