- Not insured by the FDIC or any other government agency

- Not bank guaranteed

- Not a deposit or obligation

- May lose value

You need to carefully examine your finances, especially before you plan to retire or resign, to gain a solid overview of how you can enhance your income and stay on track to meet your financial goals. Financial planning and analysis are the first steps of determining how to manage and distribute your finances. Beyond that, establishing a financial plan is not enough. It is essential to monitor the situation, review your plan regularly, and adjust to make sure it still fits.

Maintaining a comfortable standard of living and well-being throughout life is up to each person. Therefore, you should develop an individualized wealth plan that meets your needs both now and in the future. This option helps provide sufficient passive income after retirement or in the case of significant life changes.

The Great Resignation is the mass resignation that began in early 2021, primarily in the U.S., due to the COVID-19 pandemic disrupting economic and social norms. This has been pushing workers to reevaluate their employment ambitions and goals.

According to the U.S. Bureau of Labor Statistics, 4.3 million U.S. citizens resigned in December 2021 alone. In addition, most people who resigned during the pandemic are focusing on better compensation, a better work-life balance, more benefits in the workplace, and the need for more financial stability.

You need to analyze how your decision to quit your full-time job can affect all aspects of your life. Understanding the financial planning basics and having a step-by-step plan can help you have the confidence to make a sound, well-considered decision.

Assessing your income involves not only the income you earn from your full-time job but also the financial assets and investment instruments that contribute to your overall revenue. This could be company stocks and bonds, income from real estate, or extra income from sources generated over a given period.

Therefore, your priority is to estimate the amount of money you will receive after you leave your job and whether it is enough to maintain a stable standard of living.

Emergency Savings refers to an accumulated amount of money that allows you to keep your expenses and standard of living intact in unexpected situations, such as losing your primary source of income.

The risk of losing a job is always present to some degree in everyone's life. Moreover, the situation in the labor market is constantly changing, and certain professions may no longer be in-demand during an economic crisis. That is why, despite a planned retirement and a well-thought-out budget, building a financial backup protects against all contingencies.

Financial planning involves understanding how much you spend on average per month. You can calculate your financial savings by multiplying the amount you spend each month by the number of months you want to build up your cash reserve.

Some steps to build a financial backup include:

When considering resigning from your current position, you must understand that if your employer provided health insurance during your tenure, you become responsible for covering any future medical costs.

Therefore, finding alternative health insurance may become one of the most important financial challenges you should address – especially amid a pandemic. When the cost of health insurance depends on the income level, and if a person loses a stable source of revenue, there is a chance to get government-supported healthcare insurance coverage.

The two standard federal health insurance coverage plans in the U.S. are:

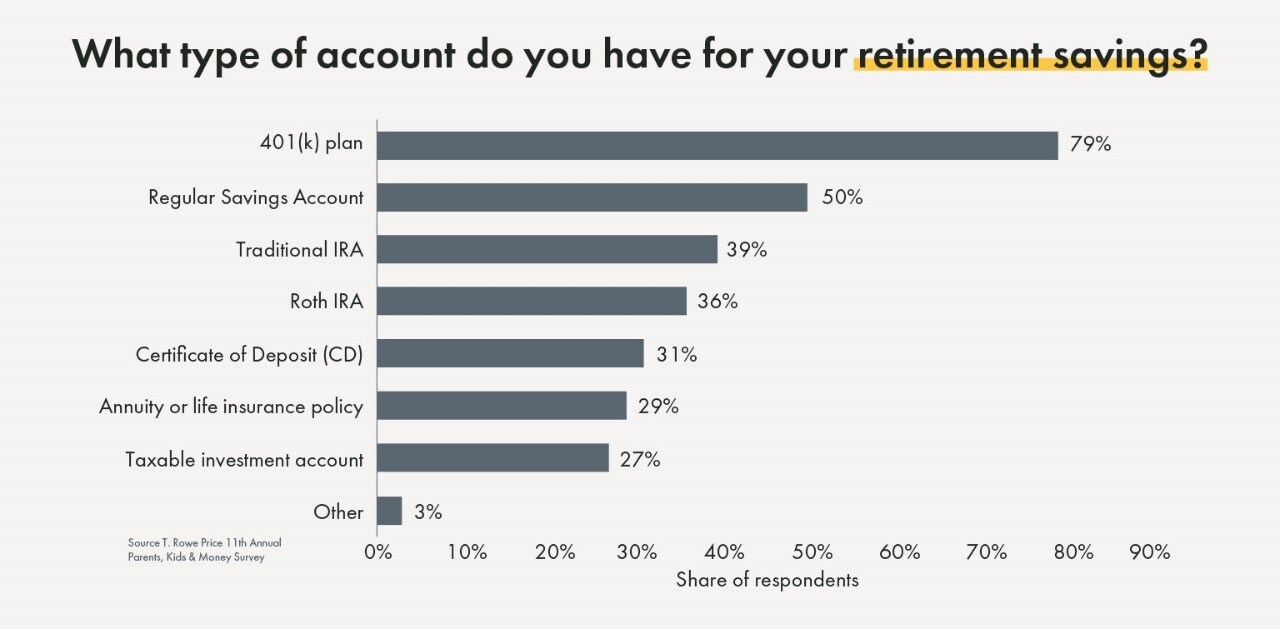

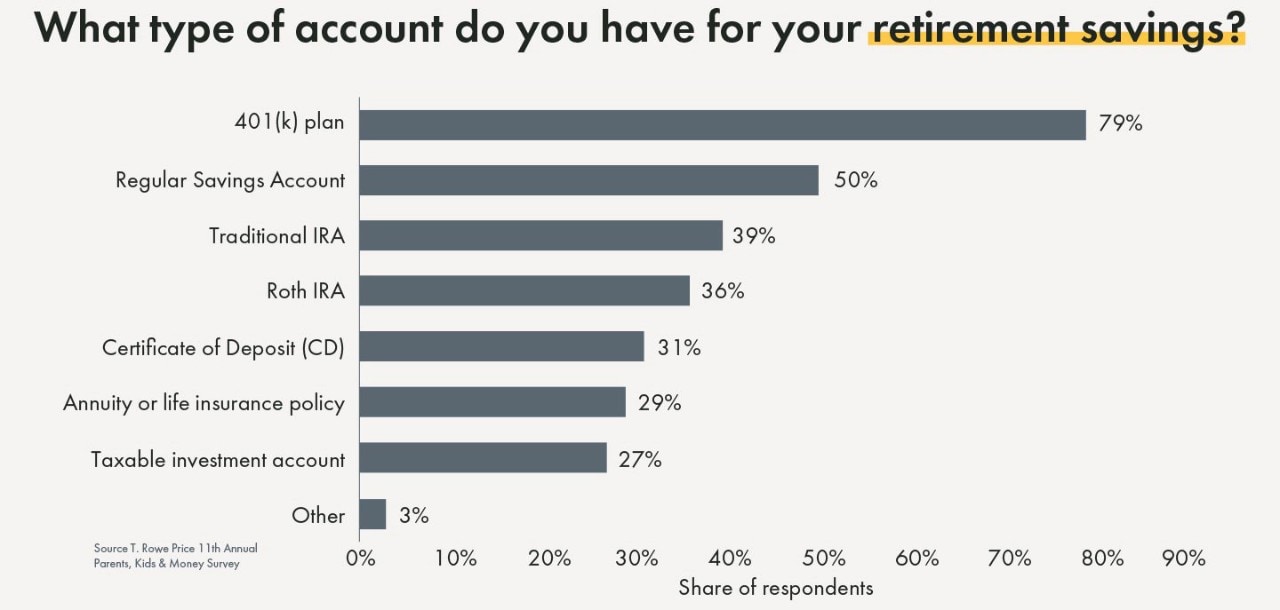

The retirement system in the U.S. may include several components in the formation of benefits for citizens in retirement, namely, Social Security benefits, retirement deductions according to a specific retirement plan, and personal savings. The amount of retirement benefits will depend on years of employment, salary for the entire period of employment, and contributions to the federal retirement system.

The most popular retirement plans in the U.S. are 401(k) and IRAs. They are both retirement plans that are funded by the employee or IRA owner. 401(k) plans can also include employer contributions. Before you make a vital decision to resign, you need to assess the impact of this step on the future formation of your pension.

If your employer provides you with a 401(k) or other retirement plans, you will no longer be able to contribute to the plan once you leave your job. This can impact your retirement savings significantly, so it's a good idea to find an alternative beforehand to provide yourself with a decent income after retirement.

One option when you resign is to transfer to an individual retirement account, especially if you don't have another job that involves a retirement savings plan. Moreover, you may consider retirement savings programs that offer investment plans for your retirement savings.

Planning for your financial future takes time, and while it may seem rather daunting at first, with proper help and guidance, it’s much easier to manage than you may think. Whether you’re preparing for retirement or want to have a plan in place in case of unforeseen circumstances, such as an unexpected resignation, our team of professional wealth advisors can help.

Yellow Cardinal Advisory Group offers a personalized approach and customized solutions to help our clients build a secure financial future. Our specialists provide financial planning services and help assess strengths and point out weaknesses in financial planning to help you make the right decision and build financial stability.

Get in touch with us for proper financial advice.

Featured Image 1: Adapted from “What is Personal Finance?” by Divij Chadha, Wealth Imperio.

Featured Image 2: Adapted from “How to Save for Retirement with the Right Retirement Planning Budget,” by Intuit; https://mint.intuit.com/blog/planning/financial-goals-how-to-make-a-budget-to-save-for-retirement/

The information on this page is accurate as of March 2022 and is subject to change. First Financial Bank is not affiliated with any third-parties or third-party websites mentioned above. Any reference to any person, organization, activity, product, and/or service does not constitute or imply an endorsement. By clicking on a third-party link, you acknowledge you are leaving bankatfirst.com. First Financial Bank is not responsible for the content or security of any linked web page.

You are about to go to a different website or app. The privacy and security policies of this site may be different than ours. We do not control and are not responsible for the content, products or services.

Online banking services for individuals and small/medium-sized businesses.

If you haven't enrolled yet, please enroll in online banking.

Yellow Cardinal resources

* Are not insured by the FDIC. Not a deposit. May lose value.

f1RSTNAVIGATOR is where our business clients can access tools to help manage day-to-day account activity.

If you’re a Westfield Bank client OR new to fIRSTNAVIGATOR Online Banking after 02/26/26, sign in here to access your day-to-day account activity. Current First Financial clients should continue to use the sign in above.

If you are still unsure, please contact the Business Support Center at 866.604.7946.

You are encouraged to bookmark the platform page once you have successfully accessed your account.