- Not insured by the FDIC or any other government agency

- Not bank guaranteed

- Not a deposit or obligation

- May lose value

It’s never too early to plan your exit strategy. Unforeseen events, market changes or lifestyle changes, and major events can occur unexpectedly. For example, the pandemic affected many business owners’ succession plans and exit strategies.

Some business owners may not have any succession plan in place at all. Yet, implementing a succession plan is a crucial planning step and can set you up for a smooth exit while also protecting the financial interests of your company and family.

When creating your business succession plan, take a holistic approach that accounts for your business and personal goals and that meets the needs of your company and family.

Business owners exit their companies for various reasons, such as retirement or new opportunities. There are also common triggering events that can cause an expected sale such as disagreement, divorce, or disability.

Business succession planning should ensure a smooth exit and incorporate strategies that will build a better foundation for the company, leading to stronger growth and business cohesion.

During the early stages of planning, consider all the options. Do you want to pass the business to a child or other family member? Is it time that a new partner takes over managing duties? Keep your options open.

The purpose of business succession planning is to ensure the long-term continuity of the entity to which you have likely dedicated significant time, money, and brainpower. A succession plan not only preserves the current business but also protects its value.

Here’s how to create and implement a successful succession plan.

Whether you plan to keep the business in the family and pass it down to the next generation or sell to a new external owner, the method of choosing a successor will depend on many factors.

Learn about potential successors below.

In a partnership, consider selling your business interests to your partner(s) through a buy-sell agreement.

Owners of closely-held businesses often choose children or other family members within the organization to take over.

For a business structure other than a partnership, consider whether a key employee is prepared to succeed you. Consult your organization chart to determine potential leaders.

When selling to a business partner, family member, or key employee is not possible, the business community is another option. An entrepreneur or even competitor may have an interest in your business.

Once you’ve identified your ideal exit strategy, determine your business’s net worth. Value is perceived through the eye of the beholder. Different exit strategies will attract different buyers, each of which may be interested in a different facet of your business.

The real question, however, is to identify the type of plan you want, i.e. family transfer, ESOP, management buyout, sale to the outside. The type of exit should be considered, not the buyer itself, before determining value. The value may be tweaked depending on the type of transfer. For example, discounts may apply for a family transfer.

Other valuation considerations at a minimum include reviewed but preferably audited financial statements including:

After identifying your desired exit type, collaborate with your leadership team to implement a transition plan and timeline.

After all, succession planning is not a one-person job. It takes a group of experts working collaboratively to do it best.

Your team may include:

Depending on your chosen succession plan, you may need folks like ESOP trustees, M&A advisors, or even a family counselor.

A successful business succession plan is executed with intention and purpose to ensure the continuation of the business into future generations. A productive plan enables your business to continue operations during a disruptive process.

An external analyst with financial expertise can prove critical. At Yellow Cardinal M&A Services, we have the specialized knowledge and unbiased view you need to evaluate your options and determine which succession plans are viable for your company.

Yellow Cardinal M&A Services doing business as Yellow Cardinal Business Succession Services offers business succession planning services. Contact us to get started.

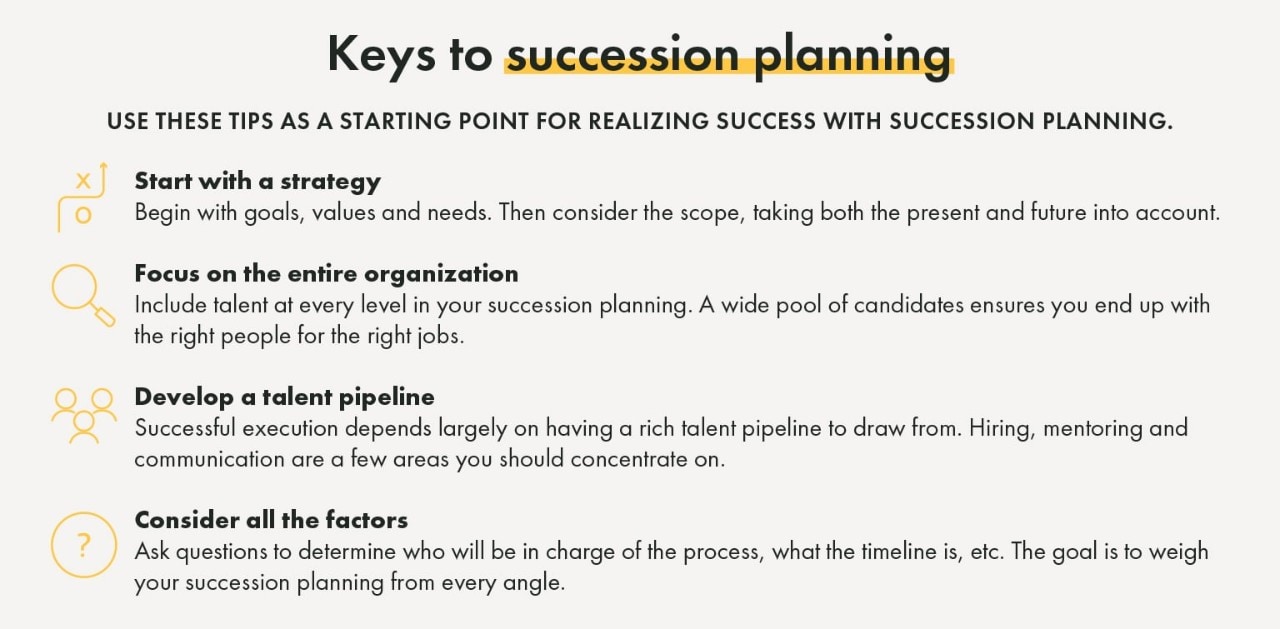

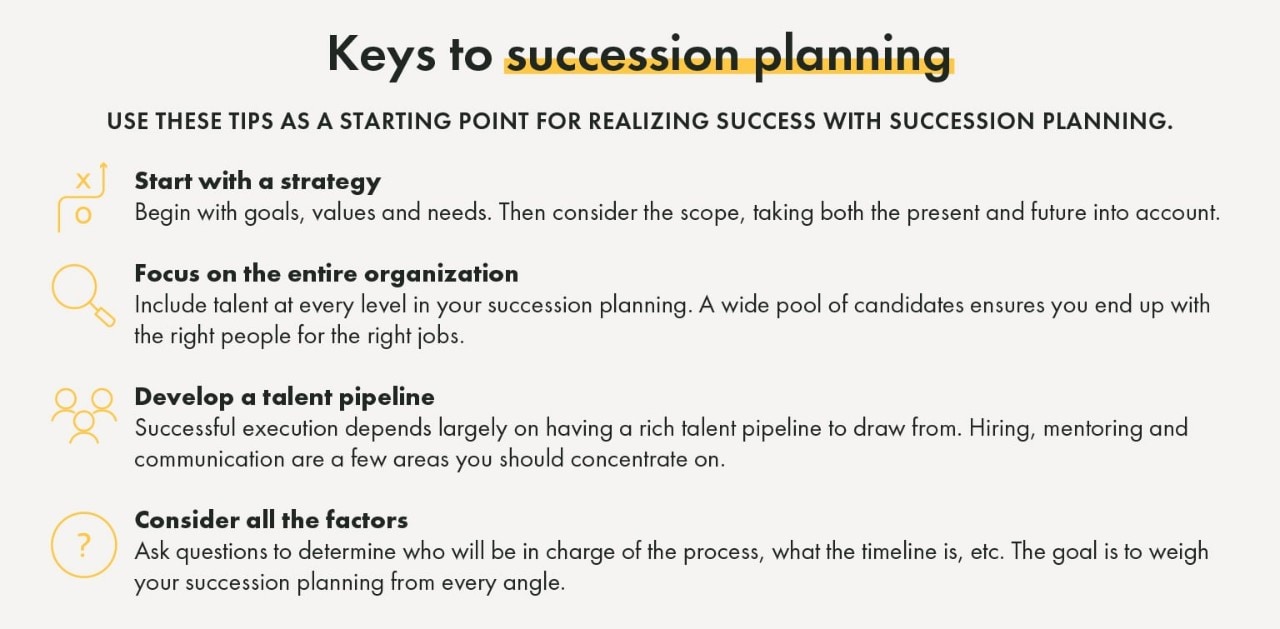

Keys to Succession Planning graphic: Adapted from "What is Succession Planning? Key Strategies and Benefits," by Zachary Totah, SelectHub; https://www.selecthub.com/talent-management/succession-planning-means-nurturing-talent-pipeline-throughout-organization/.

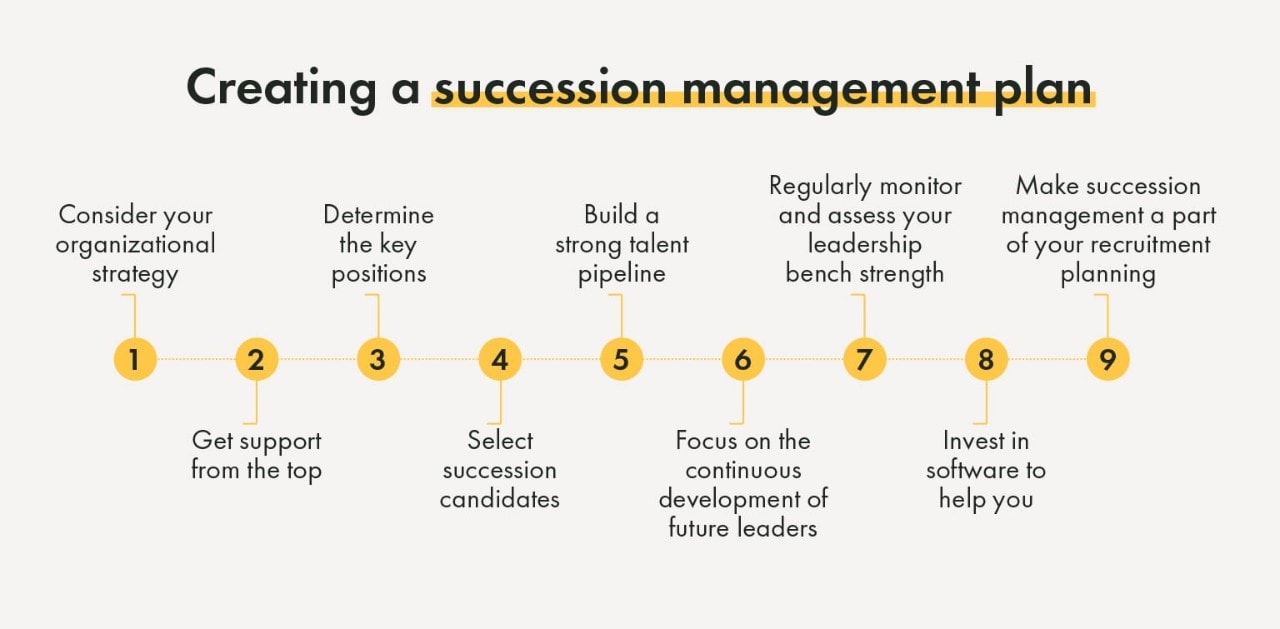

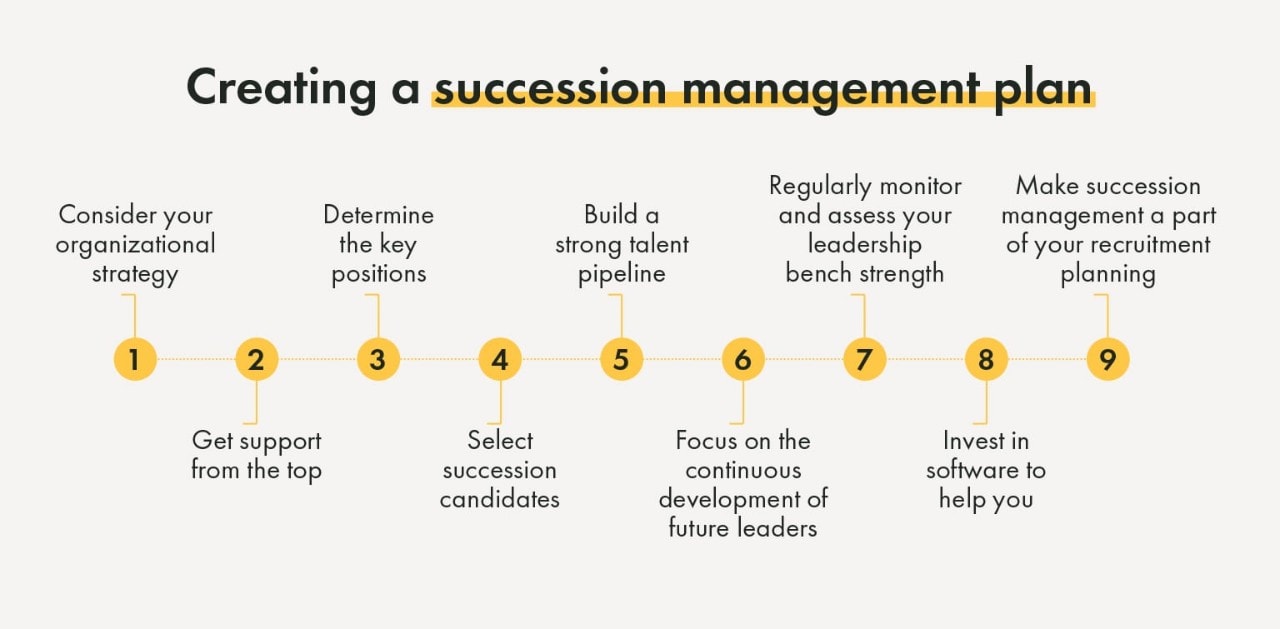

Creating a Succession Management Plan graphic: Adapted from "Succession Management: 9 Steps For Future Success," by Shani Jay, Academy to Innovate HR; https://www.aihr.com/blog/succession-management/.

The information on this page is accurate as of June 2022 and is subject to change. First Financial Bank and Yellow Cardinal are not affiliated with any third-parties or third-party websites mentioned above. Any reference to any person, organization, activity, product, and/or service does not constitute or imply an endorsement. By clicking on a third-party link, you acknowledge you are leaving bankatfirst.com. First Financial Bank and Yellow Cardinal are not responsible for the content or security of any linked web page.

You are about to go to a different website or app. The privacy and security policies of this site may be different than ours. We do not control and are not responsible for the content, products or services.

Online banking services for individuals and small/medium-sized businesses.

If you haven't enrolled yet, please enroll in online banking.

Yellow Cardinal resources

* Are not insured by the FDIC. Not a deposit. May lose value.

f1RSTNAVIGATOR is where our business clients can access tools to help manage day-to-day account activity.

If you’re a Westfield Bank client OR new to fIRSTNAVIGATOR Online Banking after 02/26/26, sign in here to access your day-to-day account activity. Current First Financial clients should continue to use the sign in above.

If you are still unsure, please contact the Business Support Center at 866.604.7946.

You are encouraged to bookmark the platform page once you have successfully accessed your account.