- Not insured by the FDIC or any other government agency

- Not bank guaranteed

- Not a deposit or obligation

- May lose value

With nearly 70 million recipients in 2020, the Social Security Administration (SSA) has done well to streamline the application process as best it can. However, many people still struggle to understand how to apply for benefits.

People frustrated with the process give up and don't take full advantage of their retirement benefits. That can leave a significant gap in their financial plan.

If you are approaching retirement age, this introduction to Social Security benefits will help you determine if you qualify, calculate your benefit amount, and the steps to apply.

To qualify for social security benefits, you must either be 62 or older or permanently disabled. Commonly, social security plays a role in your financial plan for retirement and serves as a supplement to your retirement savings.

Applying for benefits and calculating monthly payment amounts are nearly the same. However, there are a few differences between retirement and disability benefits.

For this article, let's discuss the process for those approaching retirement age.

To qualify, you and your employer must have contributed 15.3% of your gross earnings (before taxes). Each party pays half with 6.2% contributions to social security and 1.45% for Medicare.

Other qualifying factors include:

The administration considers a series of factors when calculating your benefits. One is your retirement age and the amount paid into your benefits from your payroll liabilities.

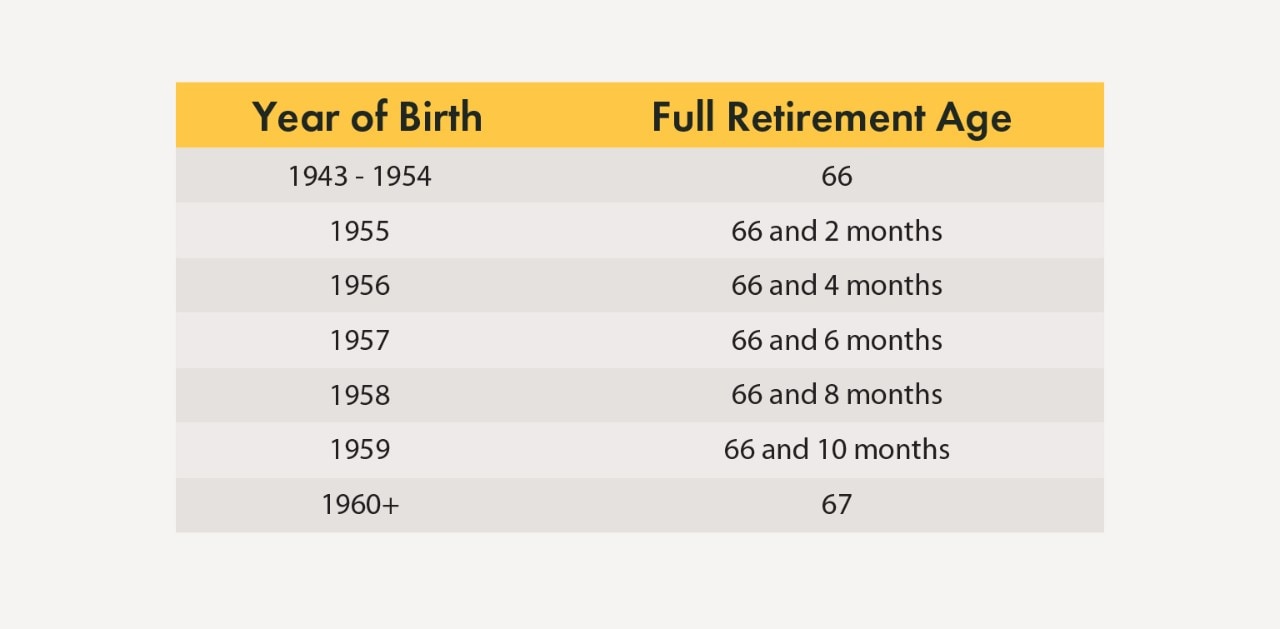

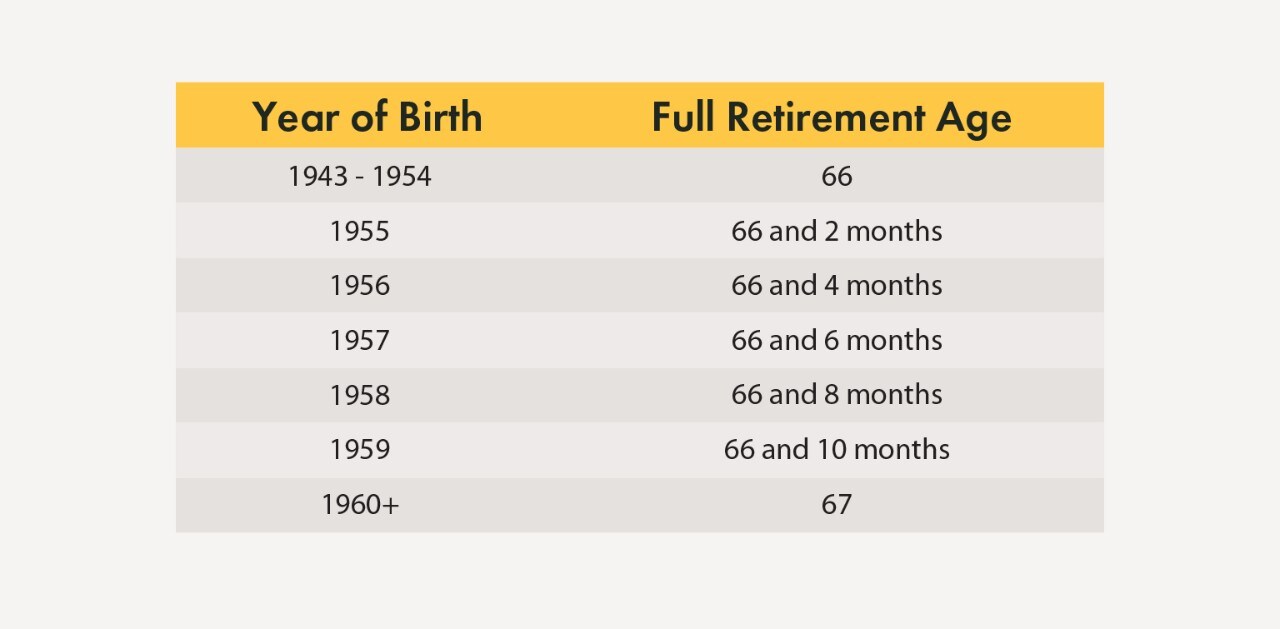

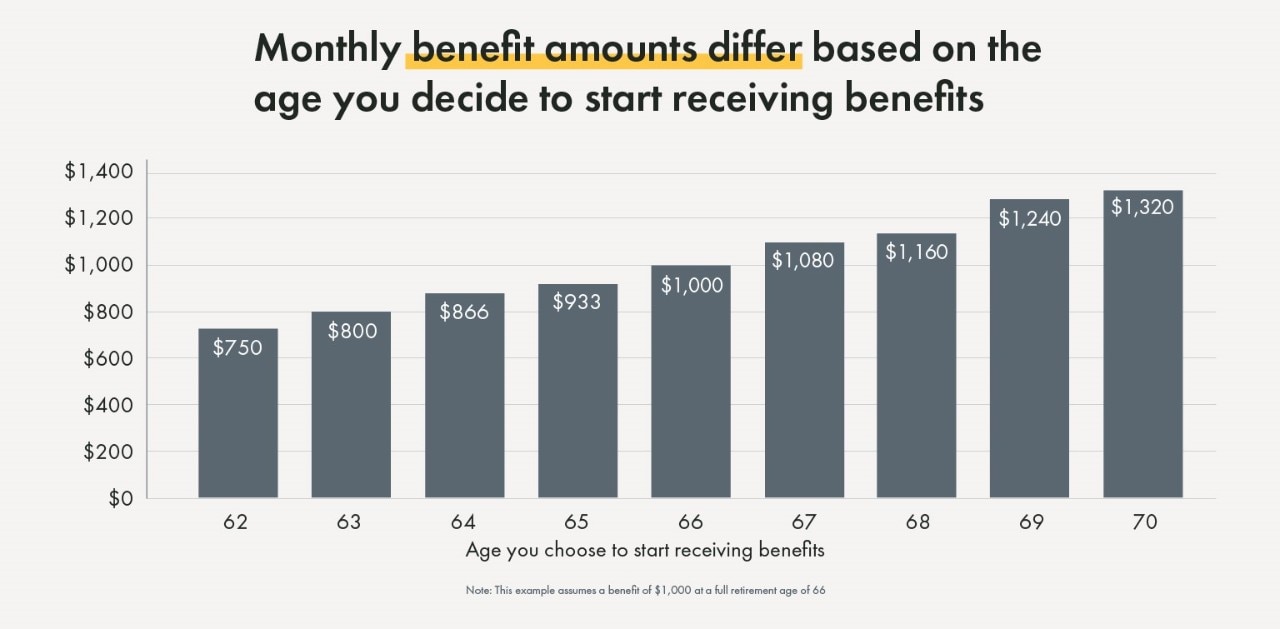

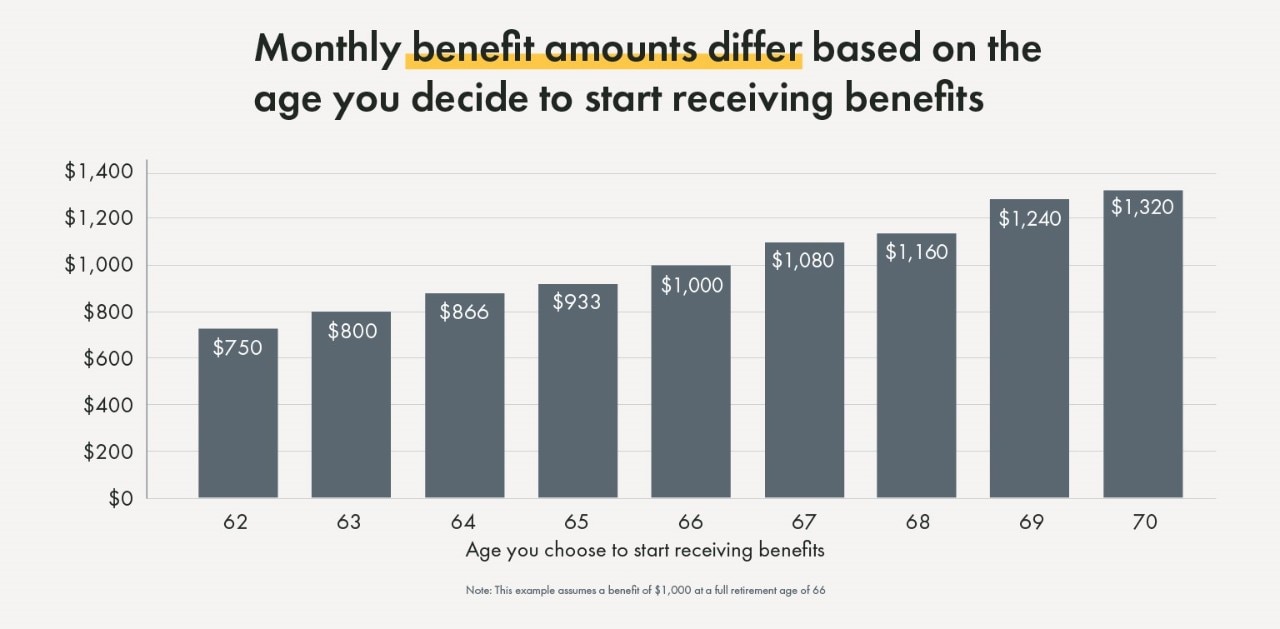

The best age to retire is completely up to you. The percentage of benefits you receive will vary based on whether you are at full retirement age or how many years away from that age you are at the time of application.

Below is an illustration of monthly benefits for someone who qualifies for $1,000 of Social Security benefits at the age of 66 (the full retirement age).

The first thing the SSA will do to determine your monthly benefit amount is to calculate your average indexed monthly earnings (AIME). They do this by inflating all earnings through age 59 and extracting the highest earnings for 35 years.

Next, the administration will total the earnings from those 35 years and divide that sum by 420 – the total months equal to 35 years. That is how the SSA will calculate your monthly retirement benefits payments.

Once the administration determines your AIME, it will calculate your primary insurance amount (PIA).

This information is available on the SSA.gov website. These Historical Bend Points may vary, so you may want to reach out to an advisory group that can help or speak to someone at the SSA for more information.

The SSA can reduce your benefits. It is known as the Windfall Elimination Provision and impacts how the administration calculates your retirement and disability benefits.

It occurs when an employer does not withhold social security insurance from your pay when filing your employee liabilities with the federal government. These provisions may apply when one of the following applies:

This rule continues to apply even if you are actively working. It also impacts benefits for people that performed federal service after 1956 under the Civil Service Retirement System (CSRS). That rule does not apply to Federal Employees' Retirement System (FERS) earnings.

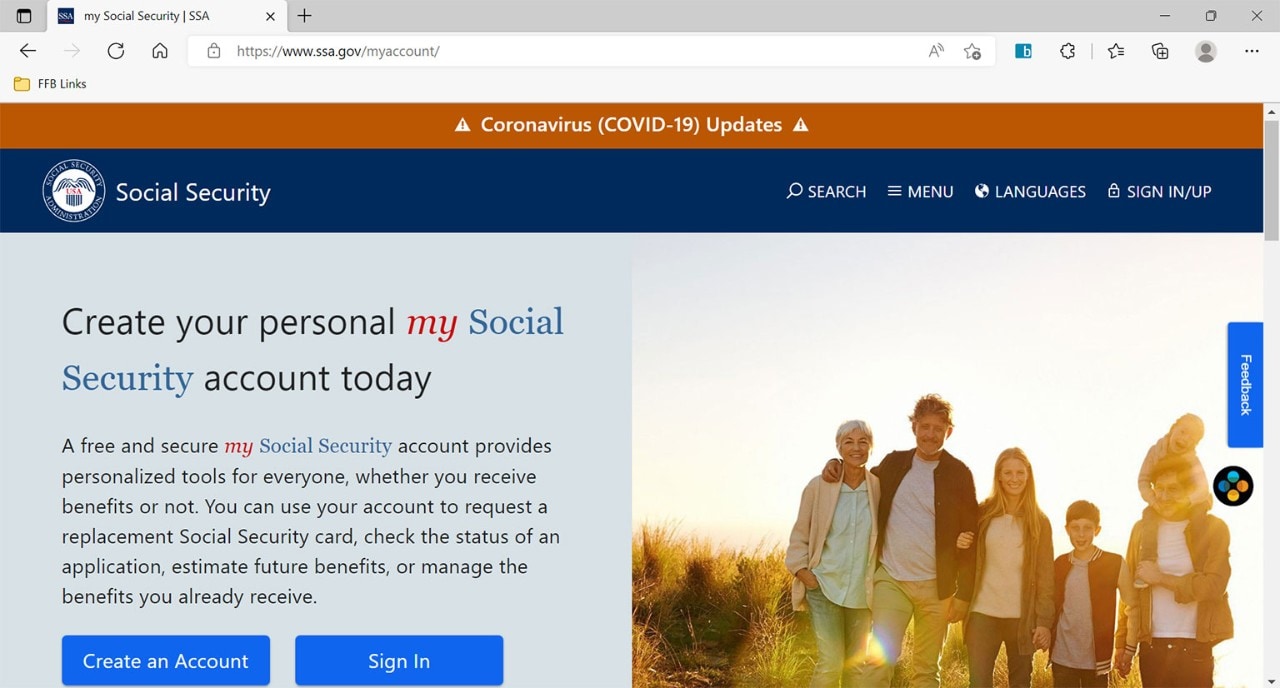

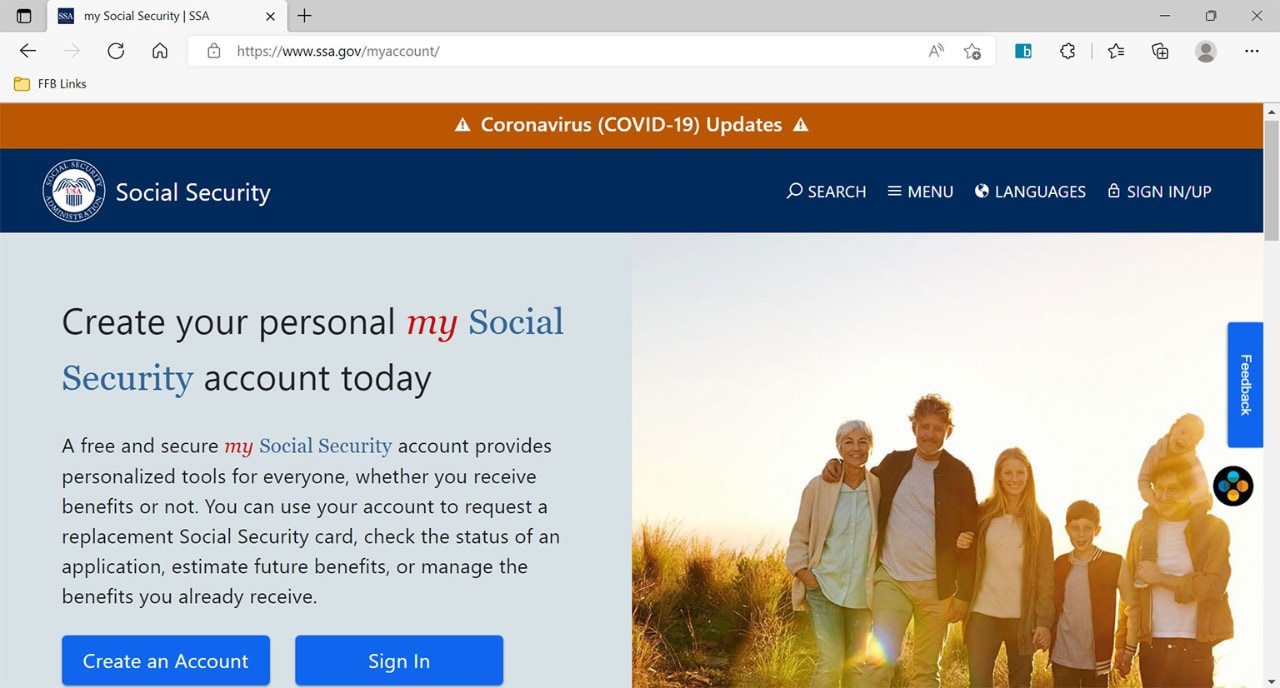

If you are still unsure about your monthly benefit and have earned enough qualifying credits, check out your mySocialSecurity account. If you do not have an SSA.gov account, below are the steps for creating one.

It's essential to note that anyone can create an account. The sooner you plan, the better. If you're closer to retirement, it's even more important to create an account and monitor it annually.

Go to your computer, open your favorite web browser, enter the URL "https://www.ssa.gov/myaccount/," and hit enter. You can also search "SSA my account" or similar variations in the search bar. (Alternatively, you can create an account through Login.gov.)

From the SSA.gov myAccount page, locate the button that says, "Create an Account," and click on that link. You will then get redirected to the Login.gov page.

You will see a prompt to enter your email address, choose your preferred language, accept the rules of use, and click submit. It will also prompt you to choose a password.

Remember, do not share your login and password information with anyone, even someone you explicitly trust. You are the only person who should access your account unless you have a legal proxy to manage it on your behalf.

Setting up an account allows you to get personalized retirement benefit estimates, check the status of a claim, and update your address and direct deposit information.

If you cannot use the website, you can call their national number or schedule an appointment with your local SSA office.

Planning for retirement is both exciting and nerve-racking. At Yellow Cardinal Advisory Group, we can help you navigate the waters of financial planning for retirement.

We want to help you prepare for your financial future. We have been doing this for over 150 years and want to be your finance professionals. We are here to answer any questions about your social security benefits.

For more information on obtaining social security benefits and how to get started on financial wellness during retirement, contact us today.

Graphic Image 1: Adapted from “What is full retirement age?”, Social Security Administration; https://www.ssa.gov/OP_Home/cfr20/404/404-0409.htm

Graphic Image 2: Adapted from “When to start receiving retirement benefits," Social Secuiry Administration; https://www.ssa.gov/pubs/EN-05-10147.pdf

The information on this page is accurate as of August 2022 and is subject to change. First Financial Bank and Yellow Cardinal Advisory Group are not affiliated with any third-parties or third-party websites mentioned above. Any reference to any person, organization, activity, product, and/or service does not constitute or imply an endorsement. By clicking on a third-party link, you acknowledge you are leaving bankatfirst.com. First Financial Bank and Yellow Cardinal Advisory Group are not responsible for the content or security of any linked web page.

You are about to go to a different website or app. The privacy and security policies of this site may be different than ours. We do not control and are not responsible for the content, products or services.

Online banking services for individuals and small/medium-sized businesses.

If you haven't enrolled yet, please enroll in online banking.

Yellow Cardinal resources

* Are not insured by the FDIC. Not a deposit. May lose value.

f1RSTNAVIGATOR is where our business clients can access tools to help manage day-to-day account activity.