Case Study: Bridgewater Studio and the Value of the Big Picture

Overview

Bridgewater Studio was a successful mid-market creative studio that struggled to find a bank that understood their work and their goals. The personal relationship they forged with First Financial Bank led to a seamless transition and a comprehensive lending strategy that touches on all their needs, with a forward-thinking aim towards growth.

The problem

In 2020, despite their history as a reliable customer, Bridgewater was told by their then-bank it no longer wanted to service businesses of their size.

“We had to scramble to find another bank that wanted our business,” recalls Founder and CEO, Eric Cup.

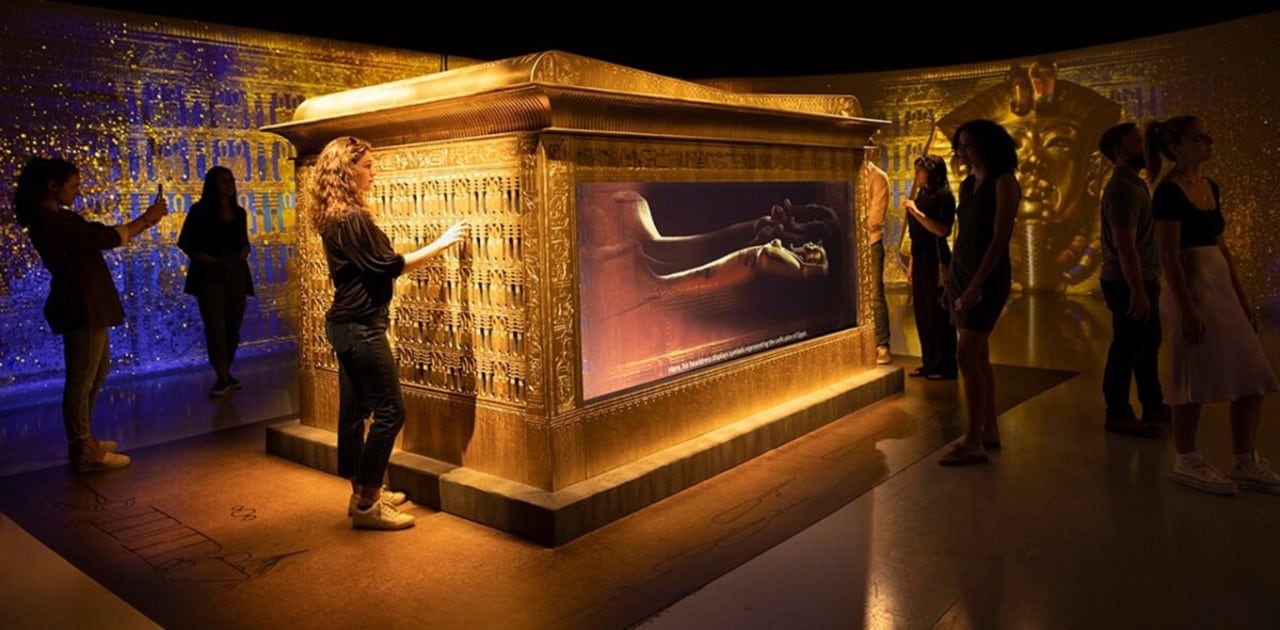

The company had experienced 100% year over year growth until the pandemic, and even managed to break even in 2020. Yet finding the right fit for their next bank proved to be difficult. Bridgewater Studio is a unique entity. “Design and fabrication studio” does not quite do them justice. Eric, who started his career in technical theater, refers to their work as “theatre of the real world.” They craft experiences—museum exhibitions, immersive art, office environments, and more. Bridgewater Studio is a full-source vendor, taking a client’s project from design concept through to fabrication, installation, and all the way to opening day.

Eric started the company with just a small line of credit, business checking account, and business savings account. As the studio grew, the jobs became more complex and with longer timelines. They expanded with a clear strategic direction, but retained a flexibility that allowed them to pivot quickly. In fact, when the entertainment industry shut down in 2020, they broke even because they used their existing equipment to fabricate face shields. However, the creativity and malleability that made them successful was making it difficult to transition to the right financial partner.

Thanks to overlapping professional circles, Eric was introduced to Seth Freeman at First Financial Bank. Seth and his colleagues held multiple meetings to get to know Eric, his team, and Bridgewater Studio itself—truly learning who they were, who they are, and who they want to be.

Seth reflects on what he discovered, observing, “One bank thought they were growing too quickly. Another bank was smaller and wanted to collateralize all the loans with hard assets, which is unsustainable in a growth model."

The First Financial team stepped back and looked at the big picture. By recognizing that 2021 was negatively impacted by the pandemic, in actuality the “too quick” spike in 2023 created an average steady rate of growth overall. The First Financial team was able to secure a softer credit that could grow as the accounts receivable grew.

The service didn’t end there. Once credit was secured, First Financial team members led video calls and trainings to make sure Bridgewater had the solutions in place to run the business effectively. Four entities needed new depository accounts, the company needed treasury management services, and all accessibility and functionality had to run smoothly so that Bridgewater’s clients’ projects remained uninterrupted. Accounts and services were live and accessible one full week before closing, giving time to test processes and address concerns within 24-48 hours.

Seth takes pride in the successful transitions he and his team manage. “The number one hesitation in talking to a bank is the transition and the move,” he acknowledges. “All the product training, all the transitions to the new routing number, the new account number—it’s a huge undertaking, but we were prepared and proactive.

Eric is more than satisfied with the results of their partnership, saying, “As an entrepreneur, as a job creator, having a partner you are able to text and ask questions, who serves as devil’s advocate when needed—that relationship is the key differentiator. I would tell everybody.”