- Not insured by the FDIC or any other government agency

- Not bank guaranteed

- Not a deposit or obligation

- May lose value

If you're at a point where you're considering how to build a legacy for your family and community, you've likely spent your career devoted to your profession and building personal wealth.

When it comes to leaving your legacy, you may consider transferring assets to your children and family and to charitable organizations. Either way, legacy and estate planning will help you implement a strategy that meets your goals.

Creating your legacy involves more than planning for estate and transfer taxes. You must evaluate your motivations, whom you want to impact, and how you'll achieve your goals.

Anyone can leave their estate – no matter the size – to family members and charitable causes. Creating a legacy is a different matter. A legacy solidifies your life's work tangibly.

Although you won't see the result, your legacy is the climax of your life's efforts. To build your legacy, first, define what "legacy" means for you. Consider local and global issues: Is there an organization that has a mission you strongly share? Has the prevalence of homelessness increased in your city? Could you contribute to your town's education system?

With your legacy, the scope is up to you. That's why it's important to understand your purpose, values, and beliefs. You can identify your core motivators and pinpoint how you want your community and family to remember you.

Once you've identified your legacy, it's time to make it happen. One way to ensure that your estate becomes a legacy after you pass is to work with an estate planner.

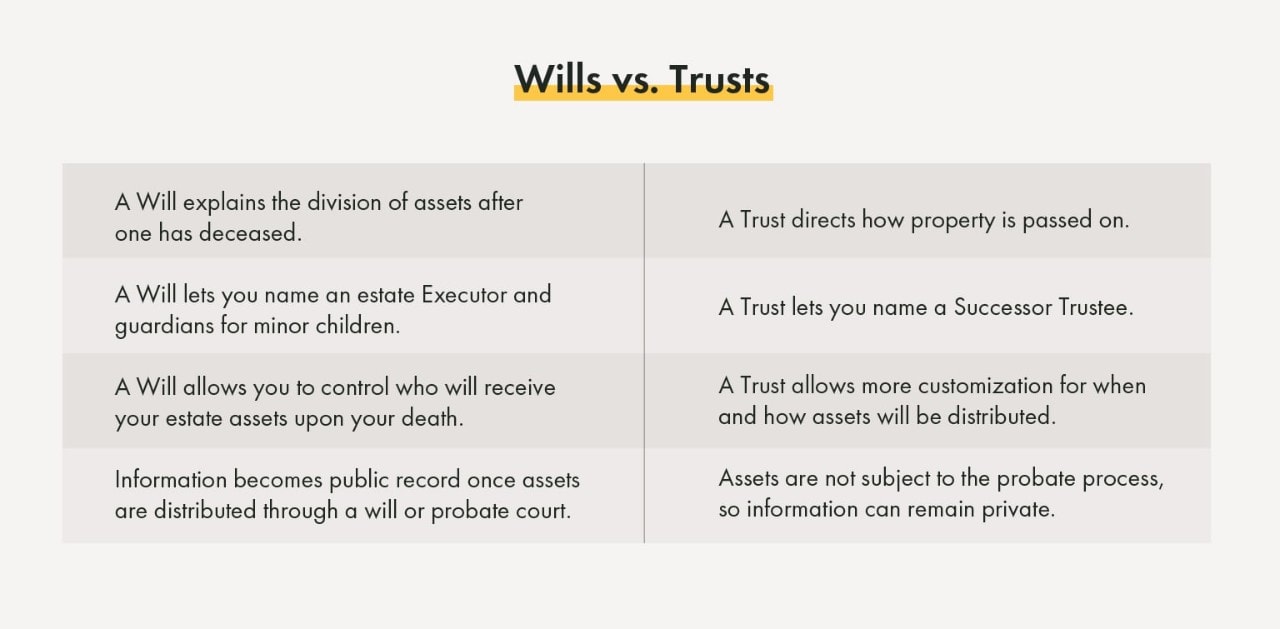

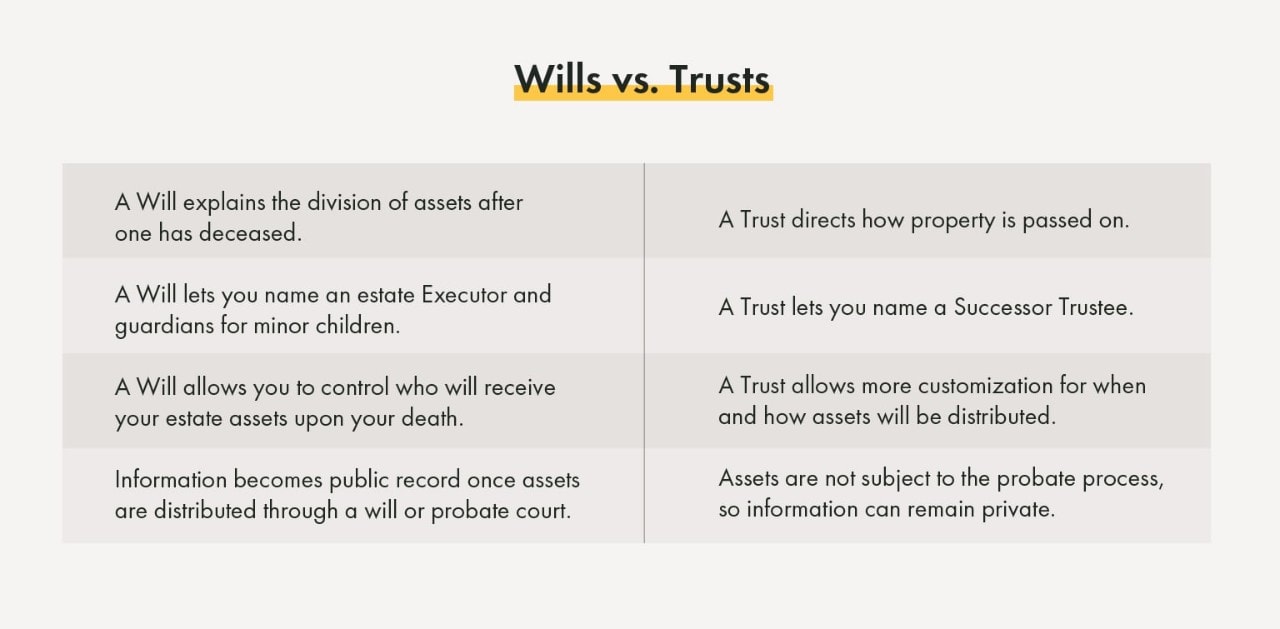

There are several formal documents you should complete to create your legal estate. This ensures that your personal representative distributes your estate and assets according to your wishes. Without these documents, your family or the state will decide what happens. A good starting point is to speak with your advisor.

Consider creating a:

Estate law varies from state to state. While a living will differs from an RLT, some states' laws treat one more favorably than the other. Consulting with an estate attorney and wealth advisor can help you create the legacy you want.

The beneficiaries of your estate may receive substantial money and assets. How will they manage those assets – and will you have a say?

After creating a legacy, you want it to last.

You can maintain some legal control over the distribution of the assets by creating some type of trust. Because a revocable trust becomes irrevocable upon death, an RLT may be more beneficial. This will also put the assets outside the reach of some creditors should something happen to the trust beneficiaries.

If you're leaving your estate to children or family, their financial wherewithal may concern you. Some parents worry that leaving a substantial estate to their kids may disincentivize them from pursuing their own careers.

Just like with a charitable organization, you can create some type of trust to control the distribution of assets to your heirs. You'll need to name a trustee, which can be a younger family member or trusted friend.

Sometimes, there may not be a right "person" for the job. In that case, you may want to name a corporate trustee. This could be a trust company or the trust department of a bank.

After creating your wealth, you want to maximize it by reducing your tax burden. Consider both federal and state taxes, which affect the transfer of wealth.

The last major federal overhaul occurred with the 2017 Tax Cuts and Jobs Act (TCJA). The TCJA doubled the estate tax exemption per person but expires at the end of 2025.

Until then, you won't pay taxes on transfers under $12.06 million in 2022. Anything above that, however, the government will tax at 40%. After 2025, the 40% tax rate will apply to anything over $5 million (adjusted for inflation).

On the other hand, many charitable donations are not subject to the 40% estate tax. Efficient methods of facilitating charitable giving include creating a private foundation or Donor Advised Fund (DAF).

A private foundation may be more familiar – this is a legal entity designed for only charitable purposes. The foundation is tax-exempt and typically receives its funding from a single source (i.e., your estate). You fund the foundation, and the foundation takes action to pursue your designated purpose.

On the other hand, a DAF allows you to put money into a specialized fund account without having to determine exactly which charity will receive those funds. With a DAF, you can donate cash, securities, or other assets to the fund; you then determine at a later date which charity gets the money.

Though this money or assets will not go to your children, it will go to a good cause. And when faced with the decision of paying taxes or donating that same money to charity, most people would rather donate.

To build your legacy and make it last, a wealth advisor is essential. Working with one, you can create financial documents that lock in your intended disposition of assets. With Yellow Cardinal, our experienced advisors can help you identify what's most important to you and create a financial plan.

If you're creating an estate plan and determining how to leave your legacy, contact us today to get started.

The information on this page is accurate as of August 2022 and is subject to change. First Financial Bank and Yellow Cardinal Advisory Group are not affiliated with any third-parties or third-party websites mentioned above. Any reference to any person, organization, activity, product, and/or service does not constitute or imply an endorsement. By clicking on a third-party link, you acknowledge you are leaving bankatfirst.com. First Financial Bank and Yellow Cardinal Advisory Group are not responsible for the content or security of any linked web page.

You are about to go to a different website or app. The privacy and security policies of this site may be different than ours. We do not control and are not responsible for the content, products or services.

Online banking services for individuals and small/medium-sized businesses.

If you haven't enrolled yet, please enroll in online banking.

Yellow Cardinal resources

* Are not insured by the FDIC. Not a deposit. May lose value.

f1RSTNAVIGATOR is where our business clients can access tools to help manage day-to-day account activity.

If you’re a Westfield Bank client OR new to fIRSTNAVIGATOR Online Banking after 02/26/26, sign in here to access your day-to-day account activity. Current First Financial clients should continue to use the sign in above.

If you are still unsure, please contact the Business Support Center at 866.604.7946.

You are encouraged to bookmark the platform page once you have successfully accessed your account.