- Not insured by the FDIC or any other government agency

- Not bank guaranteed

- Not a deposit or obligation

- May lose value

Current data reports show that only 30% of U.S. households have a long-term financial plan and that their median savings account balance is $7,000. Regardless of your net worth and where you are in life, you can benefit from strategic financial planning. Remember that money is a tool to support your dreams and desired living situation. Having a financial plan is necessary for effectively using and growing your money to securely support your lifestyle with confidence.

The Smart Investor’s Guide to Strategic Financial Planning will give you helpful background information and essential concepts for setting financial goals to create your strategic plan today.

Let's begin.

Strategic financial planning is about maximizing the potential of your fiscal resources—while protecting against unnecessary risk—to live a secure and fulfilling life. It’s about going from place A to place B in your financial journey, which requires knowing where you currently stand. The other benefit of having a financial plan is being able to see the likelihood of achieving your different goals, which gives you the power to make changes or reset expectations if necessary.

To begin, take stock of key measures of your finances to create a realistic strategy that will address any weaknesses in your finances and continue to build upon its strengths. Here are some of the critical measures you should review.

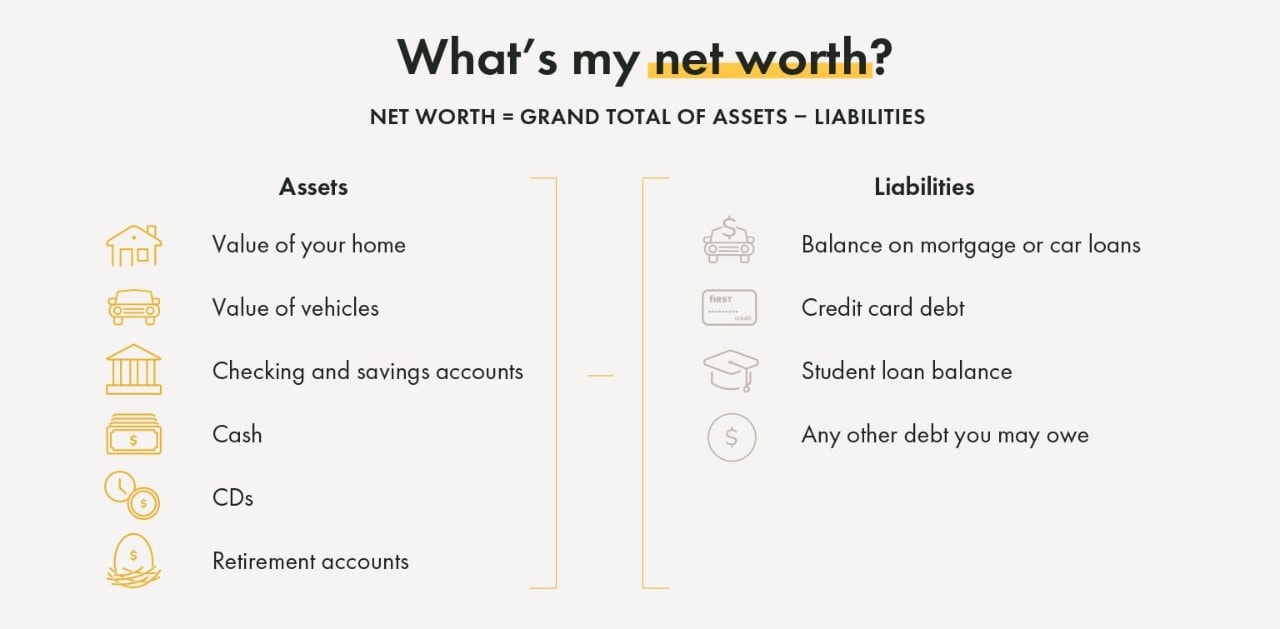

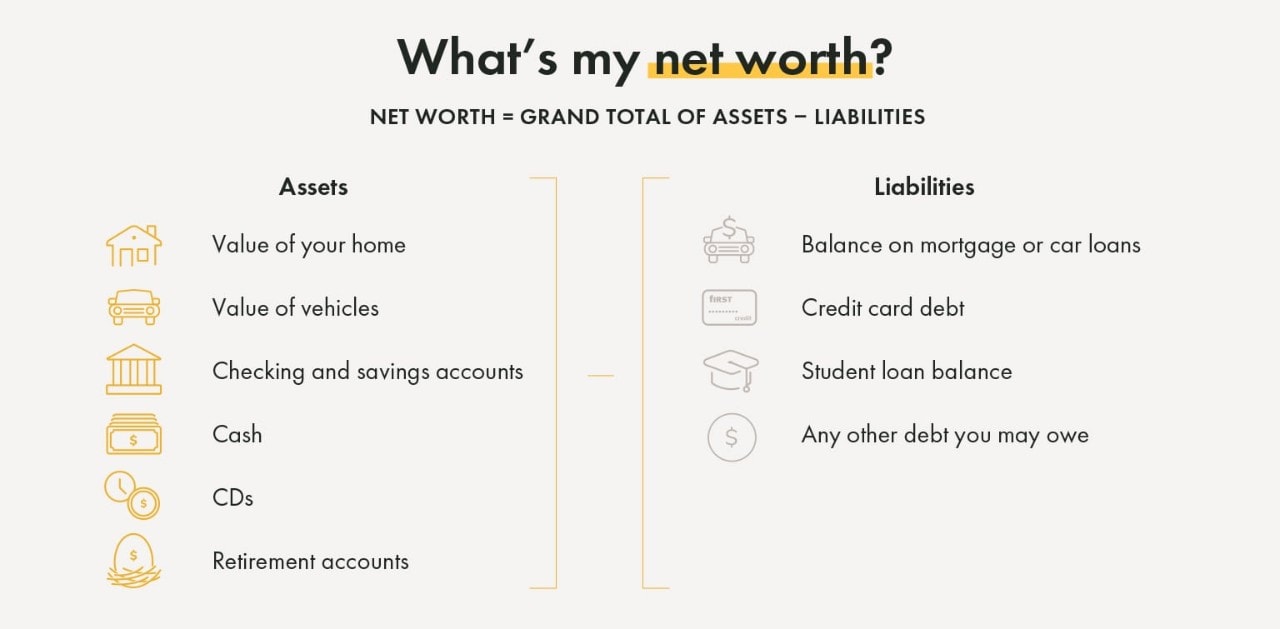

The total value of your assets minus the total value of your liabilities will give you your net worth. Your assets will include anything of value (e.g., a house, bank accounts, investment accounts, businesses, life insurance, and other property). Your liabilities are your debts and other obligations that will cost you money (e.g., student loans, mortgage, credit cards, etc.). By providing a bird’s eye view of your financial picture, being aware of your net worth can help you assess the status of long-term goals like retirement or paying off your house.

After determining your net worth, look at your current income. This includes the source of your income, value, and frequency. Figure out how much you make on an annual, quarterly, monthly, weekly, and daily basis. Income forecasting can help your financial planning by giving you realistic context for setting goals around saving, investing, and spending money. A review of your income may also shed light on the need to expand your sources of income to build a resilient financial web (e.g., passive income streams, etc.).

When reviewing your expenses, consider categorizing them based on two criteria: fixed or variable and necessary or discretionary. An excellent example of a fixed and essential expense could be your mortgage or rent, while an essential variable expense might be your grocery bill.

In comparison, a fixed discretionary expense could be a subscription to a video streaming platform, and a variable discretionary expense might be your monthly food carryout expenses. Having a firm grasp of your current finances will help you know which smart money goals to incorporate into your strategic financial plan.

Now that you know your current financial picture, you can begin to craft smart goals that will give you a strategic financial plan. Use the acronym, SMART, to set goals that are:

For example, instead of having a generic goal of achieving “financial freedom,” create a plan to have a specific net worth by a target date (e.g., $1 million by age 65).

Reverse-engineer your finance goals by starting with your long-term priorities, then working backward to discover short-term goals that will help you get there. To illustrate the point, you could achieve a goal of having a $10,000 emergency fund within a year by setting smaller goals (e.g., save $2,500 in the next 3 months).

A strategic financial plan will always benefit from allocating your resources in a diverse set of vehicles that serve the purpose of preserving and growing your assets. This means utilizing the various risk/reward benefits of different accounts and assets such as:

Acquiring a healthy mix of these assets will give you a financial plan that is resilient and capable of providing options for navigating increasingly complex financial markets and a greater economy. Furthermore, having diverse accounts with varying tax-advantaged statuses can be helpful for tax planning and mitigating tax liability during retirement years.

Conventional wisdom suggests that the only certainty in life is uncertainty. Although we work hard to create the life we want, our dreams will evolve due to internal changes or factors outside our control. As a result, periodically review your financial plan and adjust where necessary to better reflect your current goals. We’d recommend reviewing and updating your financial plan at least annually. However, in the event of significant life events, you may need to do it more frequently.

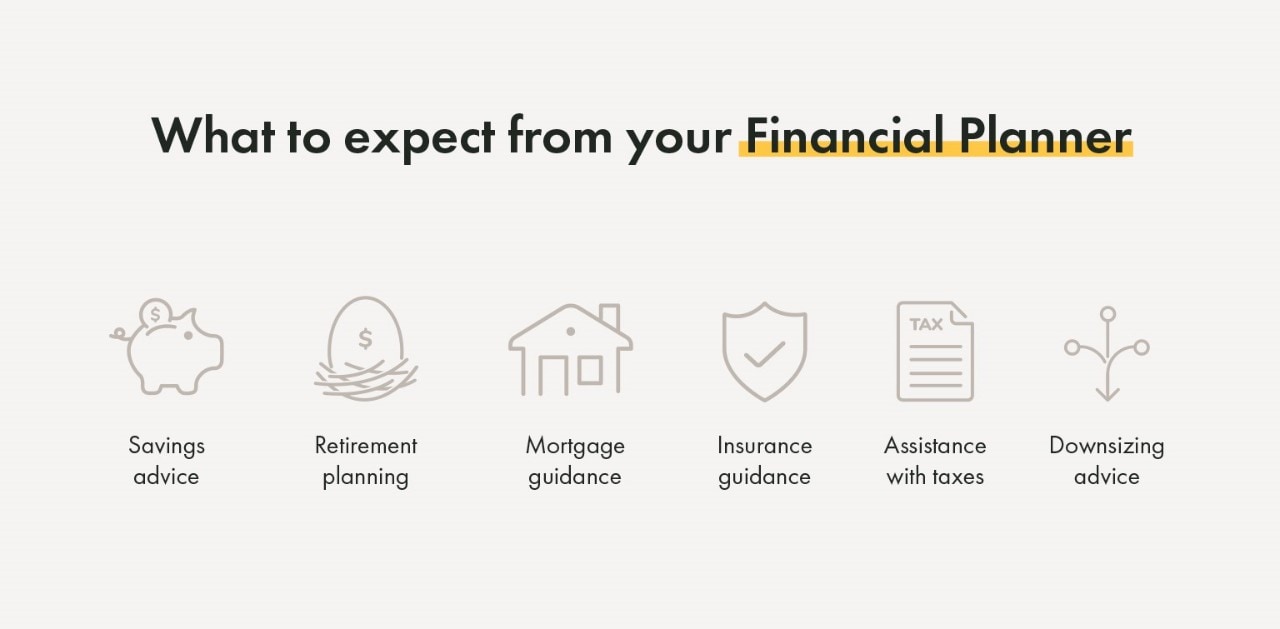

No matter your education level or background, a professional financial planner or wealth advisor can be a great resource to give you clarity and objectivity regarding critical financial decisions. While you must take ownership over the strategy of your financial plan, a professional will have experience, both first-hand and learned, that you can tap into to make well-informed choices.

At Yellow Cardinal Advisory Group, our advisors leverage the power of our goals-based financial planning software to help clients prioritize their goals into needs, wants, and wishes. We help assign specific dollar values to the items that may fit into these categories:

Our wealth advisors rely on our company’s pillars of providing personalized attention, trust, and holistic planning for our clients. We understand that all financial situations are different and recognize that individualized service is necessary to meet clients’ financial needs.

If you’re interested in collaborating with a wealth advisor to build your strategic financial plan, contact us today.

Graphic Image 1: Adapted from “What is Net Worth?” by Jeremy Vohwinkle, The Balance; https://www.thebalance.com/what-is-your-net-worth-1289788

Graphic Image 2: Adapted from “How a Financial Planner Can Help You Meet Your Goals,” by Dana Anspach, The Balance; https://www.thebalance.com/what-will-a-good-financial-planner-do-for-me-2388442

The information on this page is accurate as of April 2022 and is subject to change. First Financial Bank and Yellow Cardinal Advisory Group are not affiliated with any third-parties or third-party websites mentioned above. Any reference to any person, organization, activity, product, and/or service does not constitute or imply an endorsement. By clicking on a third-party link, you acknowledge you are leaving bankatfirst.com. First Financial Bank and Yellow Cardinal Advisory Group are not responsible for the content or security of any linked web page.

You are about to go to a different website or app. The privacy and security policies of this site may be different than ours. We do not control and are not responsible for the content, products or services.

Online banking services for individuals and small/medium-sized businesses.

If you haven't enrolled yet, please enroll in online banking.

Yellow Cardinal resources

* Are not insured by the FDIC. Not a deposit. May lose value.

f1RSTNAVIGATOR is where our business clients can access tools to help manage day-to-day account activity.

If you’re a Westfield Bank client OR new to fIRSTNAVIGATOR Online Banking after 02/26/26, sign in here to access your day-to-day account activity. Current First Financial clients should continue to use the sign in above.

If you are still unsure, please contact the Business Support Center at 866.604.7946.

You are encouraged to bookmark the platform page once you have successfully accessed your account.