- Not insured by the FDIC or any other government agency

- Not bank guaranteed

- Not a deposit or obligation

- May lose value

For retirees in the “Greatest Generation,” employer-provided pensions were common, but structural changes in the American economy since 1980 have dramatically reduced traditional defined benefit pensions for private sector workers. Instead, the burden has shifted to most private sector workers to fund their own retirements.

In this new landscape, to have income for life after retirement, intended to replace part or all of your employment income (a “personal pension”), you’ll have to build your own asset base (whether through taxable investment accounts, or tax-deferred options like 401k accounts or IRAs).

The cash flow you want to have each and every year of your retirement is a promise you’re making to yourself, and you want those promises to be fully funded. How much will that cost? And, perhaps even more importantly, how can you know if the funding you owe yourself is on track?

There are several questions to keep in mind as you consider personal pension funding levels: longevity, target annual income, risk tolerance, and projected investment returns. At Yellow Cardinal, we built an illustration to explore these considerations.

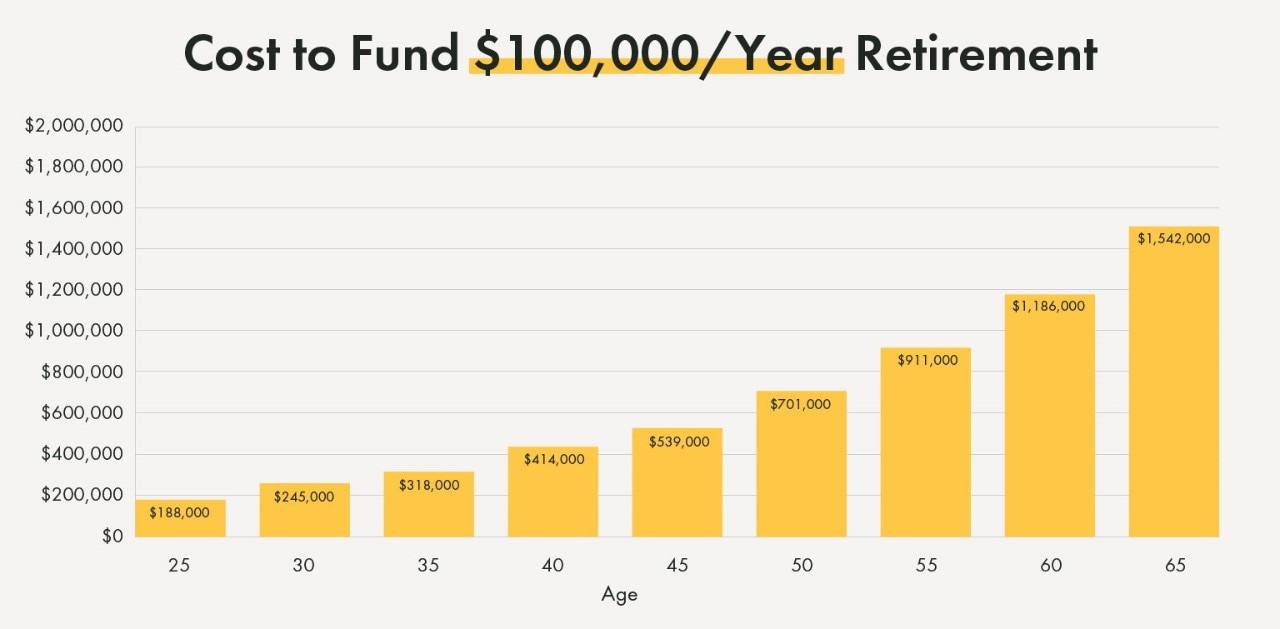

The chart below summarizes the results:1

The illustration is cautious about longevity, and assumes retirement will last until age 100. In reality, according to the Social Security Administration, 50-year-old males have a 99% chance of not living past 100 (for 50-year-old females, it’s about a 98% chance).2

Projected investment returns will vary over time, but at present, a 5.4% pre-tax return (net of inflation and net of fees) for global equities seems at least directionally reasonable.3

It’s your personal pension, so you have to decide on your own target annual income. (This example supposes you’re aiming for an inflation-adjusted $100,000 per year. If you want a larger or smaller personal pension, adjust the required funding levels at each age proportionally.) The underlying math isn’t too difficult, and details are available below for calculating funding for a single year in retirement.4

As the chart above does, it’s easy to sum each present value calculation to determine the cost to fund every year of your personal pension, and determine your retirement funding liability at any particular age before retirement. Then, by comparing that funding requirement to your current level of retirement savings, you can determine the extent your retirement is underfunded (or, a better problem to have, the extent it’s overfunded).

For instance, if our 50-year-old test subject has retirement assets of about $700,000, he’s on track to reach his personal retirement goal. Assets above that level might suggest an earlier retirement is possible, while assets below that level suggest increased savings (and/or a delayed retirement) are advisable.

By thinking about retirement saving as funding your personal pension, we see some familiar financial planning concepts in new ways:

Financing retirement is challenging. By seeing the project for what it is – funding your personal pension – you avoid making it harder than it needs to be.

1 The values reported on the chart are in current (not future) dollars. Calculations reflected in the chart are based on contributions at the beginning of each year, projected inflation of 2.4%, a retirement age of 67, and pre-tax real (e.g., post-inflation, post-fees) investment returns to an aggressive-growth-focused portfolio of 5.4%.

2 See, e.g., Social Security Period Life Table, 2020. Available at https://www.ssa.gov/oact/STATS/table4c6.html.

3 Past performance is not indicative of future results. The information provided herein is for illustrative purposes and should not be considered investment advice and is not designed to address your investment objectives, financial situation or particular needs. The information is as of the date referenced herein and is subject to change at any time based on market, economic or other conditions.

4 The present value (PV) of the future cost to fund each year of your retirement is the target income (or future value, FV) for that year, divided by (1 plus the projected return (r) on your retirement savings), compounded by the number of years (n) between now and the future year of retirement. In equation form, that’s PV = FV / ((1+r)^(n)). For instance, funding the first year of retirement from age 67 to 68 with $100,000 of annual income requires almost $41,000: $100,000 / ((1.054^(67-50)).

5 Although funding not required for the high-cost college could be earmarked for retirement instead, gift tax considerations may need to be addressed. Options include making a series of “annual exclusion” gifts during the child’s young adulthood, or a single larger “taxable” gift that may use a relatively modest portion of the lifetime gift tax exclusion amounts of the child’s parents. For specific guidance on U.S Federal gift tax rules, you should consult with a qualified tax professional or estate planning attorney.

6 The ratio of $25 of assets for every $1 drawn in annual income reflects the well-known “4% Rule” for safe withdrawal rates. First advanced by William Bengen and confirmed by the Trinity Study, but subject to continuing debate, the “4% Rule” has become a foundational financial planning “back of the envelope” assumption for safe withdrawal rates. See, e.g, W.P. Bengen, “Determining withdrawal rates using historical data” J. Financial Planning (Oct. 1994), p. 171-180, available at https://kyestates.com/wp-content/uploads/2015/02/Bengen1.pdf and P. L Cooley, C. M. Hubbard, and D.T. Walz, “Retirement savings: choosing a withdrawal rate that is sustainable” AAII Journal (Feb. 1998), p. 16-21, available at https://www.aaii.com/files/pdf/6794_retirement-savings-choosing-a-withdrawal-rate-that-is-sustainable.pdf.

The information on this page is accurate as of October 2023 and is subject to change. First Financial Bank and Yellow Cardinal Advisory Group are not affiliated with any third-parties or third-party websites mentioned above. Any reference to any person, organization, activity, product, and/or service does not constitute or imply an endorsement. By clicking on a third-party link, you acknowledge you are leaving bankatfirst.com. First Financial Bank and Yellow Cardinal Advisory Group are not responsible for the content or security of any linked web page. Member FDIC / Equal Housing Lender

The information presented in the material is general in nature and should not be considered investment advice, is not designed to address your investment objectives, financial situation or particular needs. Information is gathered from sources deemed reliable but its accuracy or completeness is not guaranteed. The opinions expressed herein may not come to pass, are as of the date of publication and are subject to change based on market, economic or other conditions.

You are about to go to a different website or app. The privacy and security policies of this site may be different than ours. We do not control and are not responsible for the content, products or services.

Online banking services for individuals and small/medium-sized businesses.

If you haven't enrolled yet, please enroll in online banking.

Yellow Cardinal resources

* Are not insured by the FDIC. Not a deposit. May lose value.

f1RSTNAVIGATOR is where our business clients can access tools to help manage day-to-day account activity.