- Not insured by the FDIC or any other government agency

- Not bank guaranteed

- Not a deposit or obligation

- May lose value

If your refrigerator went kaput today, could you replace it without taking on debt?

It’s a problem many Americans face. While 98% of U.S. households have money in a bank account, such as a savings account, only four in 10 said they could cover an unexpected $1,000 expense.1

How much should a household save? One rule of thumb is to shoot for 15% of pre-tax pay, and accumulate enough to cover six months of expenses. But consumers of all households can turn that 15% into more, without depositing more, by choosing savings accounts that earn competitive interest rates.

Such recommendations have always existed, but they are likely hitting closer to home for many more people now. Higher prices are eating into budgets and many consumers are feeling the pinch.

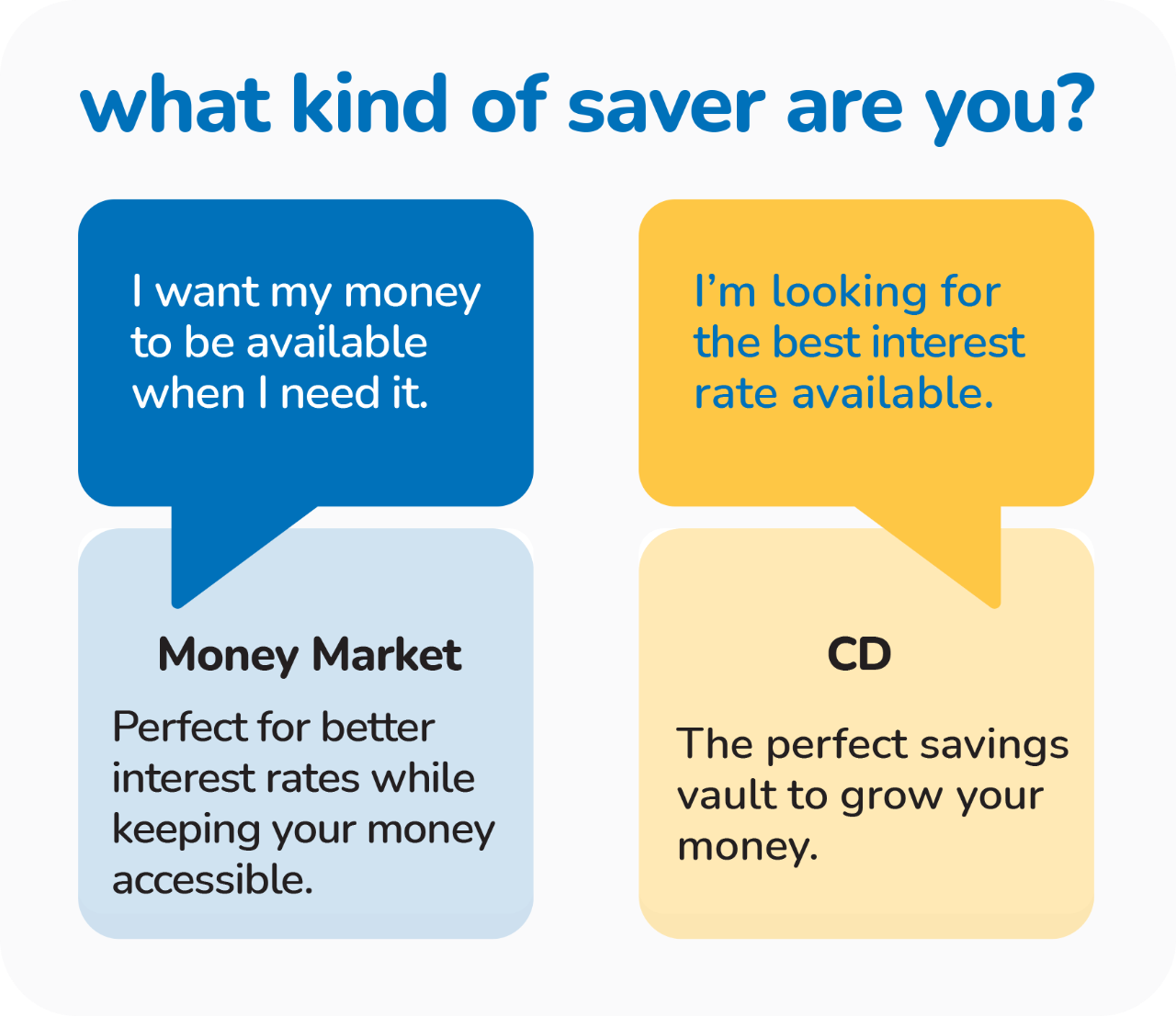

Assets such as interest-earning money market accounts and certificates of deposit, however, can be used to gain interest on savings with more favorable interest rates than other options.2

Right now, with interest rates on high-yield savings accounts climbing – some offering 3% to 4%3 – some interest-bearing accounts are growing more than other earnings options.

This enriches the incentive for squirreling away six months of savings. Only 23% of Americans carry that much in living expenses in the bank, and 26% have no savings at all.4 If these households set aside just a small amount of money in interest-bearing accounts, that savings could grow much faster today.

Where to start? Consider these popular cash-equivalent options.

One rule-of-thumb for having cash in hand is it is an equal-opportunity option. Liquid savings are advantageous to consumers of all income levels, and at all stages of life.

You don’t have to be a millionaire to feel like a million dollars when it comes to your financial choices. Money in the bank always represents security. It may not earn as much as a hot stock in good times, but it is reliable in hard times, and it’s at your fingertips.

Want to learn more about how you or other family members can be better savers? You can reach out to us in a snap, online. Just send a message and we’ll respond as quickly as we can.

1 “The average amount in U.S. savings accounts – how does your cash stack up?” By René Bennett, Bankrate.com, Dec. 21, 2022; https://www.bankrate.com/banking/savings/savings-account-average-balance/

2 “What Is a Liquid Asset, and What Are Some Examples?” By James Chen, Investopedia, Aug. 4, 2022; https://www.investopedia.com/terms/l/liquidasset.asp

3 “What is the average interest rate for savings accounts?” By Matthew Goldberg, Bankrate.com, Nov. 17, 2022; https://www.bankrate.com/banking/savings/average-savings-interest-rates/

“Best high-yield savings accounts in March 2023,” By Matthew Goldberg, Bankrate.com, March 6, 2023; https://www.bankrate.com/banking/savings/best-high-yield-interests-savings-accounts/

4 “How Does Your Emergency Fund Compare?" By Lou Carlozo, Money Under 30, Feb. 8, 2022; https://www.moneyunder30.com/compare-average-emergency-fund-savings/

5 “Financial strategies: certificate of deposit,” First Financial Bank; https://www.bankatfirst.com/personal/discover/flourish/cd-explanation.html

6 “What Is a Money Market Account?” By Margarette Burnette, NerdWallet, Sept. 9, 2021; https://www.nerdwallet.com/article/banking/faq-money-market-account

The information on this page is accurate as of November 2025 and is subject to change. First Financial Bank is not affiliated with any third-parties or third-party websites mentioned above. Any reference to any person, organization, activity, product, and/or service does not constitute or imply an endorsement. By clicking on a third-party link, you acknowledge you are leaving bankatfirst.com. First Financial Bank is not responsible for the content or security of any linked web page. Member FDIC / Equal Housing Lender.

You are about to go to a different website or app. The privacy and security policies of this site may be different than ours. We do not control and are not responsible for the content, products or services.

Online banking services for individuals and small/medium-sized businesses.

If you haven't enrolled yet, please enroll in online banking.

Yellow Cardinal resources

* Are not insured by the FDIC. Not a deposit. May lose value.

f1RSTNAVIGATOR is where our business clients can access tools to help manage day-to-day account activity.

If you’re a Westfield Bank client OR new to fIRSTNAVIGATOR Online Banking after 02/26/26, sign in here to access your day-to-day account activity. Current First Financial clients should continue to use the sign in above.

If you are still unsure, please contact the Business Support Center at 866.604.7946.

You are encouraged to bookmark the platform page once you have successfully accessed your account.